Page 150 - Microsoft Word - CAFR Title Page

P. 150

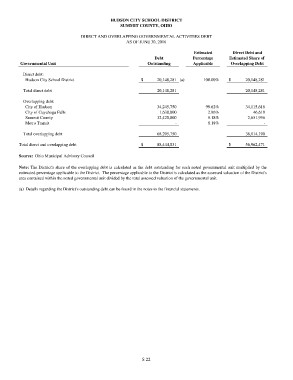

HUDSON CITY SCHOOL DISTRICT

SUMMIT COUNTY, OHIO

DIRECT AND OVERLAPPING GOVERNMENTAL ACTIVITIES DEBT

AS OF JUNE 30, 2016

Governmental Unit Debt Estimated Direct Debt and

Outstanding Percentage Estimated Share of

Applicable Overlapping Debt

Direct debt: $ 20,148,281 (a) 100.00% $ 20,148,281

Hudson City School District

Total direct debt 20,148,281 20,148,281

Overlapping debt: 34,245,750 99.62% 34,115,616

City of Hudson 1,630,000 2.86% 46,618

City of Cuyahoga Falls 8.18%

Summit County 32,420,000 8.18% 2,651,956

Metro Transit - -

Total overlapping debt 68,295,750 36,814,190

Total direct and overlapping debt $ 88,444,031 $ 56,962,471

Source: Ohio Municipal Advisory Council

Note: The District's share of the overlapping debt is calculated as the debt outstanding for each noted governmental unit multiplied by the

estimated percentage applicable to the District. The percentage applicable to the District is calculated as the assessed valuation of the District's

area contained within the noted governmental unit divided by the total assessed valuation of the governmental unit.

(a) Details regarding the District's outstanding debt can be found in the notes to the financial statements.

S 22