Page 151 - Microsoft Word - CAFR Title Page

P. 151

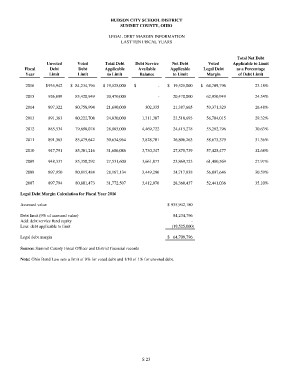

HUDSON CITY SCHOOL DISTRICT

SUMMIT COUNTY, OHIO

LEGAL DEBT MARGIN INFORMATION

LAST TEN FISCAL YEARS

Fiscal Unvoted Voted Total Debt Debt Service Net Debt Voted Total Net Debt

Year Debt Debt Applicable Available Applicable Legal Debt Applicable to Limit

Limit Limit Balance

to Limit to Limit Margin as a Percentage

of Debt Limit

2016 $935,942 $ 84,234,796 $ 19,525,000 $ - $ 19,525,000 $ 64,709,796 23.18%

2015 926,899 83,420,949 20,470,000 - 20,470,000 62,950,949 24.54%

2014 897,322 80,758,994 21,690,000 302,335 21,387,665 59,371,329 26.48%

2013 891,363 80,222,708 24,830,000 1,311,307 23,518,693 56,704,015 29.32%

2012 885,534 79,698,074 28,885,000 4,469,722 24,415,278 55,282,796 30.63%

2011 891,363 85,479,642 30,634,964 3,828,701 26,806,263 58,673,379 31.36%

2010 947,791 85,301,216 31,606,086 3,730,347 27,875,739 57,425,477 32.68%

2009 948,337 85,350,292 27,531,600 3,661,877 23,869,723 61,480,569 27.97%

2008 897,950 80,815,484 28,167,134 3,449,296 24,717,838 56,097,646 30.59%

2007 897,794 80,801,473 31,772,507 3,412,070 28,360,437 52,441,036 35.10%

Legal Debt Margin Calculation for Fiscal Year 2016

Assessed value $ 935,942,180

Debt limit (9% of assessed value) 84,234,796

Add: debt service fund equity -

Less: debt applicable to limit

(19,525,000)

Legal debt margin $ 64,709,796

Source: Summit County Fiscal Officer and District financial records

Note: Ohio Bond Law sets a limit of 9% for voted debt and 1/10 of 1% for unvoted debt.

S 23