Page 28 - Microsoft Word - CAFR Title Page

P. 28

HUDSON CITY SCHOOL DISTRICT

SUMMIT COUNTY, OHIO

MANAGEMENT’S DISCUSSION AND ANALYSIS

FOR THE FISCAL YEAR ENDED JUNE 30, 2016

(UNAUDITED)

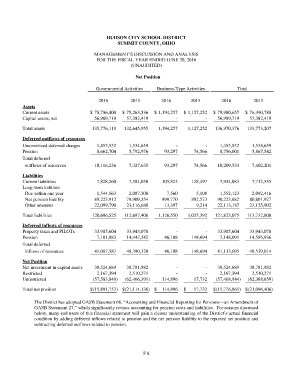

Net Position

Governmental Activities Business-Type Activities Total

2016 2015 2016 2015 2016 2015

Assets $ 78,786,400 $ 75,263,536 $ 1,194,257 $ 1,127,252 $ 79,980,657 $ 76,390,788

Current assets 56,989,719 57,382,419 - - 56,989,719 57,382,419

Capital assets, net

Total assets 135,776,119 132,645,955 1,194,257 1,127,252 136,970,376 133,773,207

Deferred outflows of resources 1,453,532 1,534,659 - - 1,453,532 1,534,659

Unamortized deferred charges 8,662,704 5,792,976 93,297 74,566 8,756,001 5,867,542

Pension

Total deferred 10,116,236 7,327,635 93,297 74,566 10,209,533 7,402,201

outflows of resources

Liabilities 7,828,260 7,584,058 105,823 128,497 7,934,083 7,712,555

Current liabilities

Long-term liabilies: 1,544,563 2,087,308 7,560 5,108 1,552,123 2,092,416

89,223,912 79,909,354 999,770 892,573 90,223,682 80,801,927

Due within one year 22,099,790 23,116,688 22,113,187 23,125,902

Net pension liability 13,397 9,214

Other amounts

Total liabilities 120,696,525 112,697,408 1,126,550 1,035,392 121,823,075 113,732,800

Deferred inflows of resources 33,985,604 33,943,078 - - 33,985,604 33,943,078

Property taxes and PILOTs 7,101,983 14,447,242 46,108 148,694 7,148,091 14,595,936

Pension

41,087,587 48,390,320 46,108 148,694 41,133,695 48,539,014

Total deferred

inflows of resources

Net Position 39,524,689 38,781,982 - - 39,524,689 38,781,982

Net investment in capital assets 2,167,394 2,510,271 - - 2,167,394 2,510,271

Restricted (57,583,840) 114,896 17,732

Unrestricted (62,406,391) (57,468,944) (62,388,659)

Total net position $(15,891,757) $(21,114,138) $ 114,896 $ 17,732 $(15,776,861) $(21,096,406)

The District has adopted GASB Statement 68, “Accounting and Financial Reporting for Pensions—an Amendment of

GASB Statement 27,” which significantly revises accounting for pension costs and liabilities. For reasons discussed

below, many end users of this financial statement will gain a clearer understanding of the District’s actual financial

condition by adding deferred inflows related to pension and the net pension liability to the reported net position and

subtracting deferred outflows related to pension.

F8