Page 37 - Microsoft Word - CAFR Title Page

P. 37

HUDSON CITY SCHOOL DISTRICT

SUMMIT COUNTY, OHIO

MANAGEMENT’S DISCUSSION AND ANALYSIS

FOR THE FISCAL YEAR ENDED JUNE 30, 2016

(UNAUDITED)

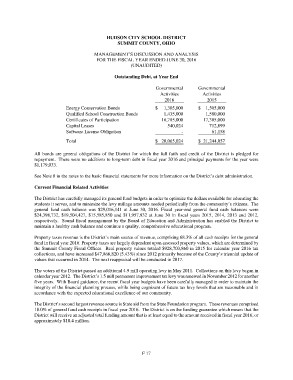

Outstanding Debt, at Year End

Energy Conservation Bonds Governmental Governmental

Qualified School Construction Bonds Activities Activities

Certificates of Participation 2016 2015

Capital Leases

Software License Obligation $ 1,305,000 $ 1,505,000

1,435,000 1,580,000

Total 16,785,000

540,024 17,385,000

- 712,899

61,158

$ 20,065,024

$ 21,244,057

All bonds are general obligations of the District for which the full faith and credit of the District is pledged for

repayment. There were no additions to long-term debt in fiscal year 2016 and principal payments for the year were

$1,179,033.

See Note 8 in the notes to the basic financial statements for more information on the District’s debt administration.

Current Financial Related Activities

The District has carefully managed its general fund budgets in order to optimize the dollars available for educating the

students it serves, and to minimize the levy millage amounts needed periodically from the community’s citizens. The

general fund cash balance was $29,016,141 at June 30, 2016. Fiscal year-end general fund cash balances were

$24,398,732, $19,504,427, $15,585,850 and $11,957,932 at June 30 in fiscal years 2015, 2014, 2013 and 2012,

respectively. Sound fiscal management by the Board of Education and Administration has enabled the District to

maintain a healthy cash balance and continue a quality, comprehensive educational program.

Property taxes revenue is the District’s main source of revenue, comprising 68.3% of all cash receipts for the general

fund in fiscal year 2016. Property taxes are largely dependent upon assessed property values, which are determined by

the Summit County Fiscal Officer. Real property values totaled $928,703,860 in 2015 for calendar year 2016 tax

collections, and have increased $47,866,820 (5.43%) since 2012 primarily because of the County’s triennial update of

values that occurred in 2014. The next reappraisal will be conducted in 2017.

The voters of the District passed an additional 4.9 mill operating levy in May 2011. Collections on this levy began in

calendar year 2012. The District’s 1.5 mill permanent improvement tax levy was renewed in November 2012 for another

five years. With Board guidance, the recent fiscal year budgets have been carefully managed in order to maintain the

integrity of the financial planning process, while being cognizant of future tax levy levels that are reasonable and in

accordance with the expected educational excellence of our community.

The District’s second largest revenue source is State aid from the State Foundation program. These revenues comprised

18.0% of general fund cash receipts in fiscal year 2016. The District is on the funding guarantee which means that the

District will receive an adjusted total funding amount that is at least equal to the amount received in fiscal year 2016, or

approximately $10.4 million.

F 17