Page 40 - Microsoft Word - CAFR Title Page

P. 40

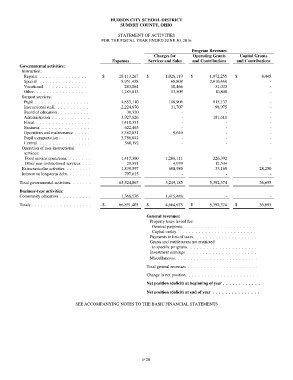

HUDSON CITY SCHOOL DISTRICT

SUMMIT COUNTY, OHIO

STATEMENT OF ACTIVITIES

FOR THE FISCAL YEAR ENDED JUNE 30, 2016

Expenses Charges for Program Revenues Capital Grants

Services and Sales Operating Grants and Contributions

and Contributions

Governmental activities: $ 28,113,267 $ 1,026,119 $ 1,972,255 $ 8,445

Instruction: 8,951,438 68,808 2,010,468 -

Regular . . . . . . . . . . . . . . . 283,061 10,466 -

1,285,813 13,509 31,033 -

Special . . . . . . . . . . . . . . . 10,800

Vocational . . . . . . . . . . . . . 4,853,110 188,906 -

Other. . . . . . . . . . . . . . . . . 2,224,870 31,707 815,137 -

Support services: - 98,975 -

Pupil . . . . . . . . . . . . . . . . . 38,520 - - -

Instructional staff. . . . . . . . . . . 3,927,626 - -

Board of education . . . . . . . . . . 1,410,351 - 181,611 -

Administration . . . . . . . . . . . . 9,640 - -

Fiscal. . . . . . . . . . . . . . . . . . 622,463 - - -

Business. . . . . . . . . . . . . . . . 5,382,831 - - -

Operations and maintenance . . . . . 3,786,842 -

Pupil transportation . . . . . . . . . . -

Central. . . . . . . . . . . . . . . . . 560,192

Operation of non-instructional

services: 1,417,360 1,206,111 226,392 -

Food service operations. . . . . . . . 29,891 4,939 12,534 -

Other non-instructional services . . . 33,169 28,250

Extracurricular activities . . . . . . . . 1,839,597 688,980 - -

Interest on long-term debt. . . . . . . . 797,635 -

5,392,374 36,695

Total governmental activities. . . . . . . 65,524,867 3,249,185

-

Business-type activities: 1,366,536 1,415,488 $ - $

Community education . . . . . . . . . . 4,664,673 5,392,374 36,695

$ 66,891,403 $

Totals . . . . . . . . . . . . . . . . . . .

General revenues:

Property taxes levied for:

General purposes. . . . . . . . . . . . . . . . . . . . . . .

Capital outlay. . . . . . . . . . . . . . . . . . . . . . . . .

Payments in lieu of taxes. . . . . . . . . . . . . . . . . . . .

Grants and entitlements not restricted

to specific programs. . . . . . . . . . . . . . . . . . . . . .

Investment earnings . . . . . . . . . . . . . . . . . . . . . .

Miscellaneous. . . . . . . . . . . . . . . . . . . . . . . . . .

Total general revenues . . . . . . . . . . . . . . . . . . . . . .

Change in net position. . . . . . . . . . . . . . . . . . . . . . .

Net position (deficit) at beginning of year . . . . . . . . . . . .

Net position (deficit) at end of year . . . . . . . . . . . . . . .

SEE ACCOMPANYING NOTES TO THE BASIC FINANCIAL STATEMENTS

F 20