Page 43 - Microsoft Word - CAFR Title Page

P. 43

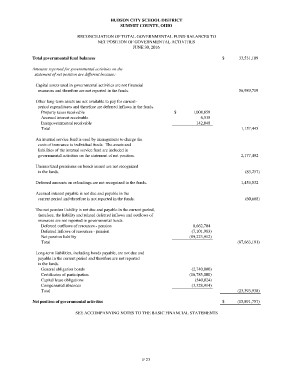

HUDSON CITY SCHOOL DISTRICT

SUMMIT COUNTY, OHIO

RECONCILIATION OF TOTAL GOVERNMENTAL FUND BALANCES TO

NET POSITION OF GOVERNMENTAL ACTIVITIES

JUNE 30, 2016

Total governmental fund balances $ 33,531,109

Amounts reported for governmental activities on the 56,989,719

statement of net position are different because:

1,157,445

Capital assets used in governmental activities are not financial 2,177,492

resources and therefore are not reported in the funds.

(83,257)

Other long-term assets are not available to pay for current- $ 1,008,859 1,453,532

period expenditures and therefore are deferred inflows in the funds. 6,538

(60,668)

Property taxes receivable 142,048

Accrued interest receivable (87,663,191)

Intergovernmental receivable

Total (23,393,938)

(15,891,757)

An internal service fund is used by management to charge the

costs of insurance to individual funds. The assets and

liabilities of the internal service fund are included in

governmental activities on the statement of net position.

Unamortized premiums on bonds issued are not recognized

in the funds.

Deferred amounts on refundings are not recognized in the funds. 8,662,704

(7,101,983)

Accrued interest payable is not due and payable in the (89,223,912)

current period and therefore is not reported in the funds.

The net pension liability is not due and payable in the current period,

therefore, the liability and related deferred inflows and outflows of

resources are not reported in governmental funds.

Deferred outflows of resources - pension

Deferred inflows of resources - pension

Net pension liability

Total

Long-term liabilities, including bonds payable, are not due and (2,740,000)

payable in the current period and therefore are not reported (16,785,000)

in the funds.

(540,024)

General obligation bonds (3,328,914)

Certificates of participation

Capital lease obligations $

Compensated absences

Total

Net position of governmental activities

SEE ACCOMPANYING NOTES TO THE BASIC FINANCIAL STATEMENTS

F 23