Page 107 - Hudson City Schools CAFR 2017

P. 107

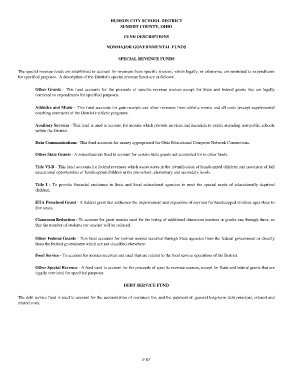

HUDSON CITY SCHOOL DISTRICT

SUMMIT COUNTY, OHIO

FUND DESCRIPTIONS

NONMAJOR GOVERNMENTAL FUNDS

SPECIAL REVENUE FUNDS

The special revenue funds are established to account for revenues from specific sources, which legally, or otherwise, are restricted to expenditures

for specified purposes. A description of the District's special revenue funds are as follows:

Other Grants - This fund accounts for the proceeds of specific revenue sources except for State and federal grants that are legally

restricted to expenditures for specified purposes.

Athletics and Music - This fund accounts for gate receipts and other revenues from athletic events and all costs (except supplemental

coaching contracts) of the District's athletic programs.

Auxiliary Services - This fund is used to account for monies which provide services and materials to pupils attending non-public schools

within the District.

Data Communications - This fund accounts for money appropriated for Ohio Educational Computer Network Connections.

Other State Grants - A miscellaneous fund to account for certain State grants not accounted for in other funds.

Title VI-B - This fund accounts for federal revenues which assist states in the identification of handicapped children and provision of full

educational opportunities of handicapped children at the pre-school, elementary and secondary levels.

Title I - To provide financial assistance to State and local educational agencies to meet the special needs of educationally deprived

children.

EHA Preschool Grant - A federal grant that addresses the improvement and expansion of services for handicapped children ages three to

five years.

Classroom Reduction - To account for grant monies used for the hiring of additional classroom teachers in grades one through three, so

that the number of students per teacher will be reduced.

Other Federal Grants - This fund accounts for various monies received through State agencies from the federal government or directly

from the federal government which are not classified elsewhere.

Food Service - To account for monies received and used that are related to the food service operations of the District.

Other Special Revenue - A fund used to account for the proceeds of specific revenue sources, except for State and federal grants that are

legally restricted for specified purposes.

DEBT SERVICE FUND

The debt service fund is used to account for the accumulation of resources for, and the payment of, general long-term debt principal, interest and

related costs.

F 83