Page 109 - Hudson City Schools CAFR 2017

P. 109

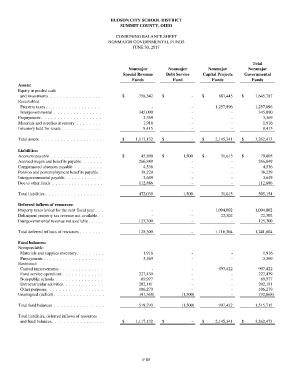

HUDSON CITY SCHOOL DISTRICT

SUMMIT COUNTY, OHIO

COMBINING BALANCE SHEET

NONMAJOR GOVERNMENTAL FUNDS

JUNE 30, 2017

Total

Nonmajor Nonmajor Nonmajor Nonmajor

Special Revenue Debt Service Capital Projects Governmental

Funds Fund Funds Funds

Assets:

Equity in pooled cash

and investments . . . . . . . . . . . . . . . . $ 758,342 $ - $ 887,445 $ 1,645,787

Receivables:

Property taxes . . . . . . . . . . . . . . . . . - - 1,257,896 1,257,896

Intergovernmental . . . . . . . . . . . . . . . 345,090 - - 345,090

Prepayments . . . . . . . . . . . . . . . . . . . 3,369 - - 3,369

Materials and supplies inventory . . . . . . . . 1,916 - - 1,916

Inventory held for resale . . . . . . . . . . . . . 8,415 - - 8,415

Total assets. . . . . . . . . . . . . . . . . . . . $ 1,117,132 $ - $ 2,145,341 $ 3,262,473

Liabilities:

Accounts payable . . . . . . . . . . . . . . . . $ 45,890 $ 1,500 $ 31,615 $ 79,005

Accrued wages and benefits payable. . . . . . . 266,849 - - 266,849

Compensated absences payable . . . . . . . . . 4,536 - - 4,536

Pension and postemployment benefits payable. . 38,229 - - 38,229

Intergovernmental payable . . . . . . . . . . . . 3,649 - - 3,649

Due to other funds . . . . . . . . . . . . . . . . 112,886 - - 112,886

Total liabilities . . . . . . . . . . . . . . . . . . 472,039 1,500 31,615 505,154

Deferred inflows of resources:

Property taxes levied for the next fiscal year . . . - - 1,094,002 1,094,002

Delinquent property tax revenue not available . . - - 22,302 22,302

Intergovernmental revenue not available . . . . . 125,300 - - 125,300

Total deferred inflows of resources . . . . . . . . 125,300 - 1,116,304 1,241,604

Fund balances:

Nonspendable:

Materials and supplies inventory. . . . . . . . . 1,916 - - 1,916

Prepayments . . . . . . . . . . . . . . . . . . . 3,369 - - 3,369

Restricted:

Capital improvements . . . . . . . . . . . . . . - - 997,422 997,422

Food service operations . . . . . . . . . . . . . 227,439 - - 227,439

Non-public schools . . . . . . . . . . . . . . . 69,977 - - 69,977

Extracurricular activities. . . . . . . . . . . . . 202,181 - - 202,181

Other purposes. . . . . . . . . . . . . . . . . . 106,279 - - 106,279

Unassigned (deficit) . . . . . . . . . . . . . . . . (91,368) (1,500) - (92,868)

Total fund balances . . . . . . . . . . . . . . . . 519,793 (1,500) 997,422 1,515,715

Total liabilities, deferred inflows of resources

and fund balances. . . . . . . . . . . . . . . . . $ 1,117,132 $ - $ 2,145,341 $ 3,262,473

F 85