Page 121 - Hudson City Schools CAFR 2017

P. 121

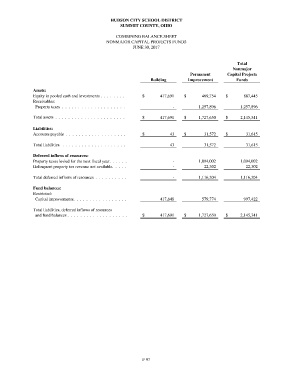

HUDSON CITY SCHOOL DISTRICT

SUMMIT COUNTY, OHIO

COMBINING BALANCE SHEET

NONMAJOR CAPITAL PROJECTS FUNDS

JUNE 30, 2017

Total

Nonmajor

Permanent Capital Projects

Building Improvement Funds

Assets:

Equity in pooled cash and investments . . . . . . . . $ 417,691 $ 469,754 $ 887,445

Receivables:

Property taxes . . . . . . . . . . . . . . . . . . . . - 1,257,896 1,257,896

Total assets . . . . . . . . . . . . . . . . . . . . . . $ 417,691 $ 1,727,650 $ 2,145,341

Liabilities:

Accounts payable . . . . . . . . . . . . . . . . . . . $ 43 $ 31,572 $ 31,615

Total liabilities. . . . . . . . . . . . . . . . . . . . . 43 31,572 31,615

Deferred inflows of resources:

Property taxes levied for the next fiscal year. . . . . . - 1,094,002 1,094,002

Delinquent property tax revenue not available. . . . . - 22,302 22,302

Total deferred inflows of resources . . . . . . . . . . - 1,116,304 1,116,304

Fund balances:

Restricted:

Capital improvements. . . . . . . . . . . . . . . . . 417,648 579,774 997,422

Total liabilities, deferred inflows of resources

and fund balances . . . . . . . . . . . . . . . . . . . $ 417,691 $ 1,727,650 $ 2,145,341

F 97