Page 144 - Hudson City Schools CAFR 2017

P. 144

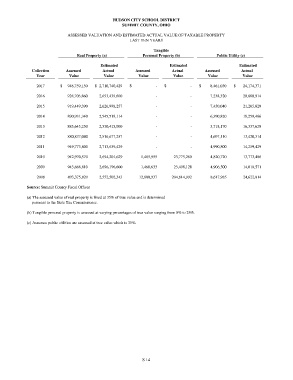

HUDSON CITY SCHOOL DISTRICT

SUMMIT COUNTY, OHIO

ASSESSED VALUATION AND ESTIMATED ACTUAL VALUE OF TAXABLE PROPERTY

LAST TEN YEARS

Tangible

Real Property (a) Personal Property (b) Public Utility (c)

Estimated Estimated Estimated

Collection Assessed Actual Assessed Actual Assessed Actual

Year Value Value Value Value Value Value

2017 $ 948,759,150 $ 2,710,740,429 $ - $ - $ 8,461,030 $ 24,174,371

2016 928,703,860 2,653,439,600 - - 7,238,320 20,680,914

2015 919,449,390 2,626,998,257 - - 7,450,040 21,285,829

2014 890,931,340 2,545,518,114 - - 6,390,820 18,259,486

2013 885,645,250 2,530,415,000 - - 5,718,170 16,337,629

2012 880,837,040 2,516,677,257 - - 4,697,110 13,420,314

2011 949,773,800 2,713,639,429 - - 4,990,800 14,259,429

2010 942,970,570 2,694,201,629 1,485,955 23,775,280 4,820,720 13,773,486

2009 943,668,810 2,696,196,600 1,468,633 23,498,128 4,906,500 14,018,571

2008 893,375,820 2,552,502,343 12,800,937 204,814,992 8,617,985 24,622,814

Source: Summit County Fiscal Officer

(a) The assessed value of real property is fixed at 35% of true value and is determined

pursuant to the State Tax Commissioner.

(b) Tangible personal property is assessed at varying percentages of true value ranging from 0% to 25%.

(c) Assumes public utilities are assessed at true value which is 35%.

S 14