Page 11 - FINAL - Brouse IR Year-End Newsletter 2021_Neat

P. 11

Utilizing Representations and Warranties Insurance in M&A Transactions and Related

Financing (Continued from page 10)

control minority investments. In addition to acquisition financing as additional insureds. By

the standard exclusions discussed below, R&W having the buyer and lender as named insured

insurance does not cover breaches in covenants and additional insured, respectively, they can be

in the purchase agreement. paid directly from the insurer. This mitigates any

collectability issues or controversy presented,

Policies Can be “Seller Side” or “Buyer Side” which is desirable in distressed transactions or

R&W insurance can be purchased as either transactions with more than a single selling

“Seller Side” or “Buyer Side” coverage. shareholder. In the event of a breach of any

R&W in the transaction, after accounting for the

Seller Side policies serve as a liability policy retention, the insured would receive a payment

providing coverage to the seller for its liability to offset their loss up to the maximum policy

for claims for breach of R&W in the purchase limits.

agreement made to the buyer. This type of

policy would pay the seller as named insured, Introducing R&W Insurance in the Deal

not the buyer. By comparison, a “Buyer Side” Sellers utilizing an investment banker led

policy is a form of first-party coverage that competitive bid or auction process often

allows the buyer to be compensated directly stipulate R&W insurance as a bid qualification

by the insurer. A common added variation to and a means they are proposing to avoid an

“Buyer Side” policies also protects the seller by escrow. By comparison, buyers seek R&W

preventing the insurance company from seeking insurance when indemnity is limited or absent,

recovery from the seller except in cases of fraud. or when escrow is not able to be obtained.

We highly recommend this variation be explored Since indemnity provisions are often the most

for our clients that are sellers. negotiated section in purchase agreements,

R&W insurance provides a mechanism for

When Hylant assists its clients in obtaining parties to bridge the gap by shifting risk of

R&W insurance, the named insured is often the breaches in R&W made by the seller and the

buyer in the transaction, with lenders providing collectability of indemnity to an insurer in

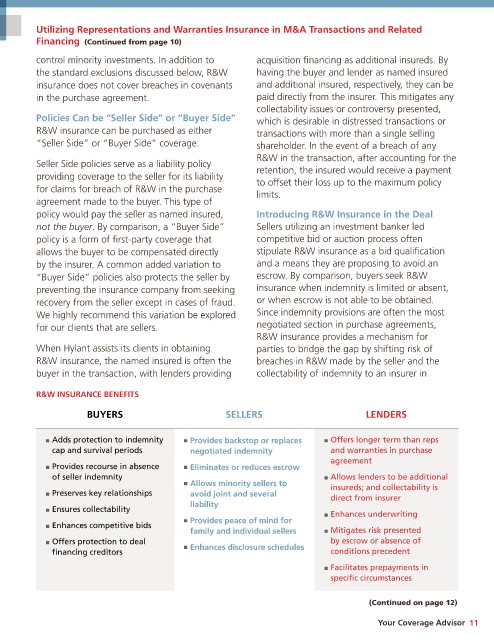

R&W INSURANCE BENEFITS

BUYERS SELLERS LENDERS

Adds protection to indemnity Provides backstop or replaces Offers longer term than reps

cap and survival periods negotiated indemnity and warranties in purchase

agreement

Provides recourse in absence Eliminates or reduces escrow

of seller indemnity Allows lenders to be additional

Allows minority sellers to insureds; and collectability is

Preserves key relationships avoid joint and several direct from insurer

liability

Ensures collectability Enhances underwriting

Provides peace of mind for

Enhances competitive bids

family and individual sellers Mitigates risk presented

Offers protection to deal Enhances disclosure schedules by escrow or absence of

financing creditors conditions precedent

Facilitates prepayments in

specific circumstances

(Continued on page 12)

Your Coverage Advisor 11