Page 12 - FINAL - Brouse IR Year-End Newsletter 2021_Neat

P. 12

Utilizing Representations and Warranties Insurance in M&A Transactions and Related

Financing (Continued from page 11)

exchange for a policy premium by providing Insurance capacity for the R&W product

the buyer, as the named insured, the ability to is robust comparable to other areas in the

collect from the insurer. Banks and other lenders insurance market. Capacity in this relatively new

providing credit are increasingly requiring R&W market continues to be positively affected by

insurance as a condition of term sheets and a insurers attempting to enter this market.

means to shift risk. The following table provides

a summary of the benefits available to buyers, Recognizing Limits of Risk Transfer

sellers, and lenders. Buyers need to recognize that R&W insurance,

while a means to transfer risk from the buyer’s

Policies are Deal-Specific balance sheet, does not provide as broad of

R&W insurance is unique in that it is fully coverage as a seller escrow of the same size.

customizable and negotiated on a deal-specific For example, R&W insurance does not provide

basis. Policy limits typically range between 10- coverage for covenants and special indemnities

20% of the enterprise value of the transaction provided in transactions or information disclosed

with retentions set at 1% to 3%. Premiums in due diligence. Buyers also need to account for

typically range from 3.5-5% of the policy limits. premiums, retention, and underwriting fees for

Because of the time-intensive underwriting, R&W insurance that the buyer will pay as part of

insurers are less motivated by deals below policy their deal models.

limits of $3 million and charge underwriting fees

of $15,000 to $40,000. Likewise, each insurer’s policy will be different,

and it is important to read and know the

differences before procuring the product and to

tailor those to the policyholder’s needs and the

circumstances surrounding the deal. Many R&W

policies contain the following exclusions:

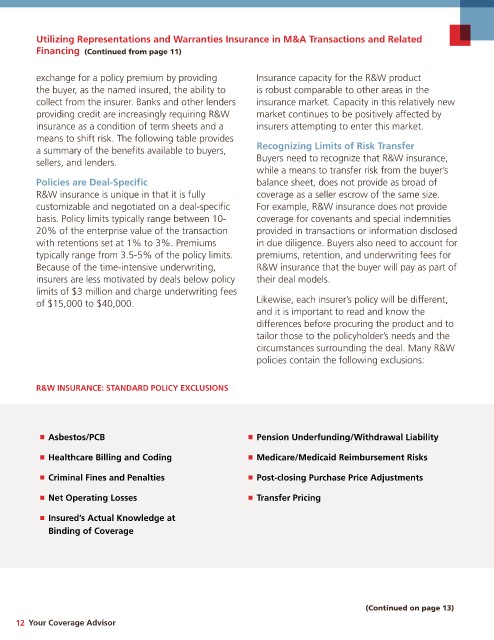

R&W INSURANCE: STANDARD POLICY EXCLUSIONS

Asbestos/PCB Pension Underfunding/Withdrawal Liability

Healthcare Billing and Coding Medicare/Medicaid Reimbursement Risks

Criminal Fines and Penalties Post-closing Purchase Price Adjustments

Net Operating Losses Transfer Pricing

Insured’s Actual Knowledge at

Binding of Coverage

(Continued on page 13)

12 Your Coverage Advisor