Page 15 - ISLE_OF_PALM-ISSUE-01-Feb2022 no crop marks 16 page

P. 15

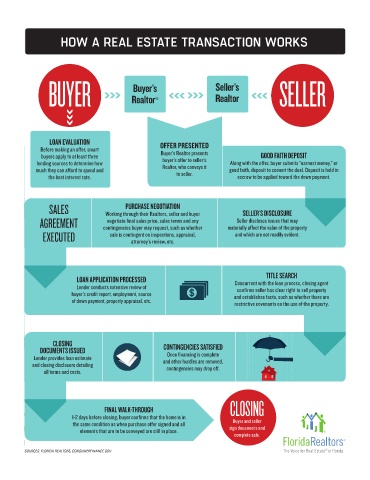

HOW A REAL ESTATE TRANSACTION WORKS

BUYER >>> Realtor® >>> >>> Realtor >>> SELLER

Seller’s

Buyer’s

>>>

LOAN EVALUATION OFFER PRESENTED

Before making an offer, smart

buyers apply to at least three Buyer’s Realtor presents GOOD FAITH DEPOSIT

lending sources to determine how buyer’s offer to seller’s Along with the offer, buyer submits “earnest money,” or

much they can afford to spend and Realtor, who conveys it good faith, deposit to cement the deal. Deposit is held in

to seller.

the best interest rate. escrow to be applied toward the down payment.

advertising

SALES Working through their Realtors, seller and buyer SELLER’S DISCLOSURE

PURCHASE NEGOTIATION

AGREEMENT contingencies buyer may request, such as whether materially affect the value of the property

Seller discloses issues that may

negotiate final sales price, sales terms and any

EXECUTED sale is contingent on inspections, appraisal, and which are not readily evident.

attorney’s review, etc.

TITLE SEARCH

LOAN APPLICATION PROCESSED

Lender conducts extensive review of Concurrent with the loan process, closing agent

confirms seller has clear right to sell property

buyer’s credit report, employment, source and establishes facts, such as whether there are

of down payment, property appraisal, etc. restrictive covenants on the use of the property.

CLOSING CONTINGENCIES SATISFIED

DOCUMENTS ISSUED

Lender provides loan estimate Once financing is complete

and closing disclosure detailing and other hurdles are removed,

contingencies may drop off.

all terms and costs.

FINAL WALK-THROUGH CLOSING

1-2 days before closing, buyer confirms that the home is in

Buyer and seller

the same condition as when purchase offer signed and all sign documents and

elements that are to be conveyed are still in place.

complete sale.

SOURCES: FLORIDA REALTORS, CONSUMERFINANCE.GOV