Page 9 - Social Securiyt - Re-Inventing It

P. 9

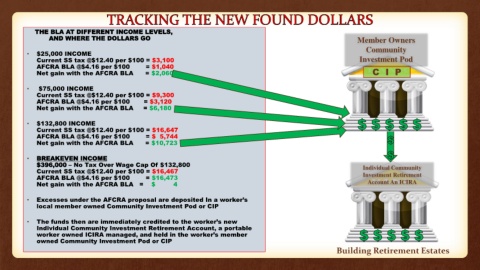

THE BLA AT DIFFERENT INCOME LEVELS,

AND WHERE THE DOLLARS GO Member Owners

Community

• $25,000 INCOME

Current SS tax @$12.40 per $100 = $3,100 Investment Pod

AFCRA BLA @$4.16 per $100 = $1,040

Net gain with the AFCRA BLA = $2,060 C I P

• $75,000 INCOME

Current SS tax @$12.40 per $100 = $9,300

AFCRA BLA @$4.16 per $100 = $3,120

Net gain with the AFCRA BLA = $6,180

• $132,800 INCOME

Current SS tax @$12.40 per $100 = $16,647

AFCRA BLA @$4.16 per $100 = $ 5,744

Net gain with the AFCRA BLA = $10,723

• BREAKEVEN INCOME

$396,000 – No Tax Over Wage Cap Of $132,800

Current SS tax @$12.40 per $100 = $16,467 Individual Community

AFCRA BLA @$4.16 per $100 = $16,473 Investment Retirement

Net gain with the AFCRA BLA = $ 4 Account An ICIRA

• Excesses under the AFCRA proposal are deposited In a worker’s

local member owned Community Investment Pod or CIP

• The funds then are immediately credited to the worker’s new

Individual Community Investment Retirement Account, a portable

worker owned ICIRA managed, and held in the worker’s member

owned Community Investment Pod or CIP

Building Retirement Estates