Page 19 - Bullion World Issue 10 February 2022_Neat

P. 19

Bullion W

Bullion World | Issue 10 | February 2022

ebruary 2022

orld | Issue 10 | F

This could signal that gold is poised

to reclaim its position as an inflation

hedge in a store of value. traders

will be watching several things to

answer that question

• Interest rates as elevated rates

tend to increase the cost of

owning gold

• cryptocurrencies as increased

volatility may push money to

look for a more stable store

value

• the path of the US dollar for

any potential signs of weakness

In terms of the Indian perspective,

the World Gold Council says that

inflation is the most important factor

fueling short-term gold demand in

India. As an inflation hedge, Indians

are turning to gold. For every 1%

Ms Renisha Chainani, Head-

increase in inflation, gold demand Research

climbs by 2.6%. Augmont Goldtech Pvt Ltd.

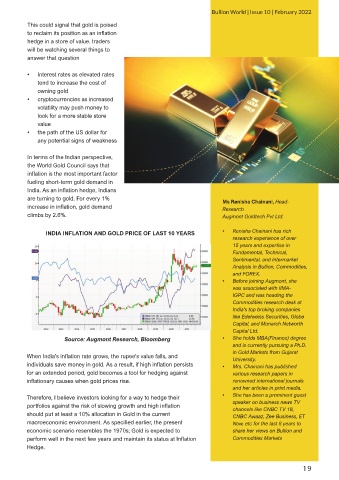

INDIA INFLATION AND GOLD PRICE OF LAST 10 YEARS • Renisha Chainani has rich

research experience of over

15 years and expertise in

Fundamental, Technical,

Sentimental, and Intermarket

Analysis in Bullion, Commodities,

and FOREX.

• Before joining Augmont, she

was associated with IIMA-

IGPC and was heading the

Commodities research desk at

India’s top broking companies

like Edelweiss Securities, Globe

Capital, and Monarch Networth

Capital Ltd.

Source: Augmont Research, Bloomberg • She holds MBA(Finance) degree

and is currently pursuing a Ph.D.

in Gold Markets from Gujarat

When India’s inflation rate grows, the rupee's value falls, and University.

individuals save money in gold. As a result, if high inflation persists • Mrs. Chainani has published

for an extended period, gold becomes a tool for hedging against various research papers in

inflationary causes when gold prices rise. renowned international journals

and her articles in print media.

Therefore, I believe investors looking for a way to hedge their • She has been a prominent guest

portfolios against the risk of slowing growth and high inflation speaker on business news TV

channels like CNBC TV 18,

should put at least a 10% allocation in Gold in the current CNBC Awaaz, Zee Business, ET

macroeconomic environment. As specified earlier, the present Now, etc for the last 8 years to

economic scenario resembles the 1970s; Gold is expected to share her views on Bullion and

perform well in the next few years and maintain its status at Inflation Commodities Markets

Hedge.

19