Page 17 - Bullion World Issue 10 February 2022_Neat

P. 17

Bullion World | Issue 10 | February 2022

Bullion World | Issue 10 | February 2022

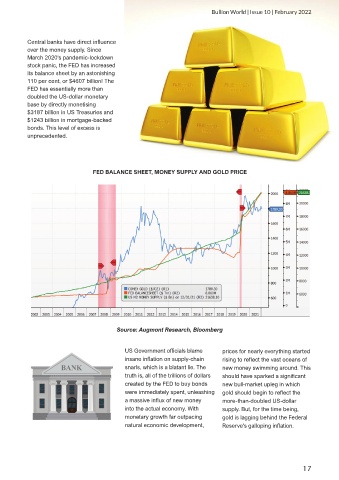

Central banks have direct influence

over the money supply. Since

March 2020's pandemic-lockdown

stock panic, the FED has increased

its balance sheet by an astonishing

110 per cent, or $4607 billion! The

FED has essentially more than

doubled the US-dollar monetary

base by directly monetising

$3187 billion in US Treasuries and

$1243 billion in mortgage-backed

bonds. This level of excess is

unprecedented.

FED BALANCE SHEET, MONEY SUPPLY AND GOLD PRICE

Source: Augmont Research, Bloomberg

US Government officials blame prices for nearly everything started

insane inflation on supply-chain rising to reflect the vast oceans of

snarls, which is a blatant lie. The new money swimming around. This

truth is, all of the trillions of dollars should have sparked a significant

created by the FED to buy bonds new bull-market upleg in which

were immediately spent, unleashing gold should begin to reflect the

a massive influx of new money more-than-doubled US-dollar

into the actual economy. With supply. But, for the time being,

monetary growth far outpacing gold is lagging behind the Federal

natural economic development, Reserve's galloping inflation.

17