Page 23 - Bullion World Volume 02 Issue 11 November 2022_Neat

P. 23

Bullion World | Volume 2 | Issue 11 | November 2022

World Gold Council - Gold Jewellery

Demand Trends Q3 2022

Continued normalisation of the market to pre-

COVID levels of activity and build-up in inventories

as growth in fabrication exceeded that of

consumption.

Global gold jewellery consumption Global gold jewellery consumption of China

recovered to pre-COVID levels 523t improved 10% y-o-y in Q3, and After the disruption of China’s

• Q3 demand benefitted from a was up 14% compared with the prior widespread Q2 lockdowns,

pullback in the gold price quarter. Demand was also healthy gold jewellery demand staged a

• India led the recovery with 17% on a longer-term comparison. comeback in Q3, rallying 58% q-o-q

y-o-y growth in demand to 146t exceeding its five-year quarterly to 163t. The y-o-y comparison

– the strongest third quarter average (501t). Y-t-d demand shows a more modest 5% increase.

since 2018 reached 1,454t, a 2% improvement Despite sporadic restrictions being

• Demand in China saw more on the same period in 2021. imposed throughout the quarter,

muted growth, up 5% y-o-y consumer sentiment in July and

as sporadic COVID-related This signals a continued August was upbeat, aided by a

restrictions impaired consumer normalisation of the market to pre- pullback in the local gold price and

sentiment. COVID levels of activity, aided by a the release of pent-up demand from

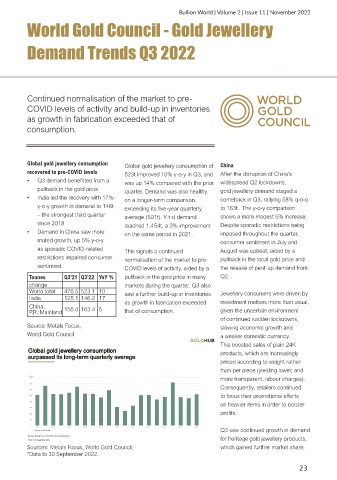

Tonnes Q3'21 Q3'22 YoY % pullback in the gold price in many Q2. .

change markets during the quarter. Q3 also

World total 476.5 523.1 10 saw a further build-up in inventories Jewellery consumers were driven by

India 125.1 146.2 17

as growth in fabrication exceeded investment motives more than usual,

China, 156.0 163.4 5

P.R.:Mainland that of consumption. given the uncertain environment

of continued sudden lockdowns,

Source: Metals Focus, slowing economic growth and

World Gold Council a weaker domestic currency.

This boosted sales of plain 24K

products, which are increasingly

priced according to weight rather

than per piece (yielding lower, and

more transparent, labour charges).

Consequently, retailers continued

to focus their promotional efforts

on heavier items in order to bolster

profits.

Q3 saw continued growth in demand

for heritage gold jewellery products,

Sources: Metals Focus, World Gold Council; which gained further market share.

*Data to 30 September 2022.

23

10-11-2022 11:35:50

BW Nov 2022.indd 23

BW Nov 2022.indd 23 10-11-2022 11:35:50