Page 38 - Bullion World Volume 03 Issue 07 July 2022

P. 38

Bullion World | Volume 2 | Issue 07 | July 2022

Constraints faced by the Indian refiners

importing Dore and the way forward

History of duty deferential in Gold refining in India. Although the gold

Imports market was liberalised in the 1990s,

efforts to curb gold imports only

India’s gold refining landscape

has changed notably over the last began in 2012, when India’s Current

decade, with the number of formal Account Deficit widened. Over just

operations increasing from less than eight months, between January

5 refiners in 2013 to 41 refiners and August 2013, the government

in 2021. As a result, the country’s raised the import duty on bullion

organised gold refining capacity fivefold, from 2% to 10%. The table

has surged to an estimated 1,800 below shows the Duty differential

tonnes compared to just 500 tonnes of Dore Imports (from countries

in 2013. like Ghana, Peru, Bolivia, etc.) and

Bullion Imports (from countries like

The import duty differential doré Switzerland, UAE, South Africa, etc.)

Renisha Chainani enjoyed over refined bullion has for the last decade:

Head - Research spurred the growth of organised

Augmont GoldTech Pvt Ltd.

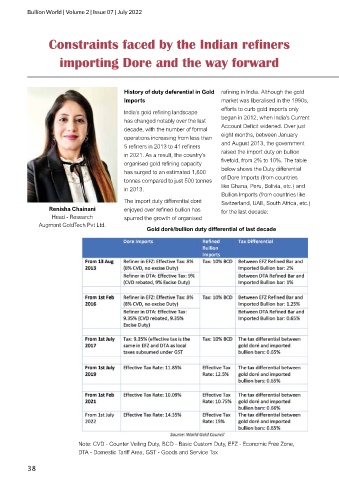

Gold doré/bullion duty differential of last decade

Note: CVD - Counter Veiling Duty, BCD - Basic Custom Duty, EFZ - Economic Free Zone,

DTA - Domestic Tariff Area, GST - Goods and Service Tax

38