Page 7 - Taxation (TAX 112 A & B, BA-203)

P. 7

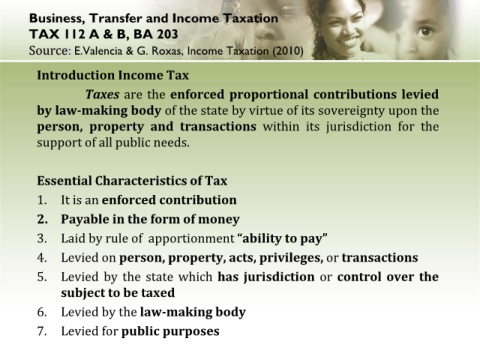

Business, Transfer and Income Taxation

TAX 112 A & B, BA 203

Source: E.Valencia & G. Roxas, Income Taxation (2010)

Introduction Income Tax

Taxes are the enforced proportional contributions levied

by law-making body of the state by virtue of its sovereignty upon the

person, property and transactions within its jurisdiction for the

support of all public needs.

Essential Characteristics of Tax

1. It is an enforced contribution

2. Payable in the form of money

3. Laid by rule of apportionment “ability to pay”

4. Levied on person, property, acts, privileges, or transactions

5. Levied by the state which has jurisdiction or control over the

subject to be taxed

6. Levied by the law-making body

7. Levied for public purposes