Page 9 - Taxation (TAX 112 A & B, BA-203)

P. 9

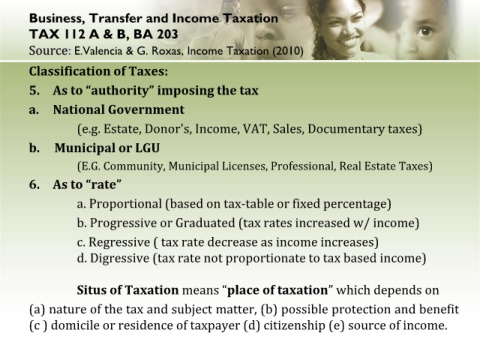

Business, Transfer and Income Taxation

TAX 112 A & B, BA 203

Source: E.Valencia & G. Roxas, Income Taxation (2010)

Classification of Taxes:

5. As to “authority” imposing the tax

a. National Government

(e.g. Estate, Donor's, Income, VAT, Sales, Documentary taxes)

b. Municipal or LGU

(E.G. Community, Municipal Licenses, Professional, Real Estate Taxes)

6. As to “rate”

a. Proportional (based on tax-table or fixed percentage)

b. Progressive or Graduated (tax rates increased w/ income)

c. Regressive ( tax rate decrease as income increases)

d. Digressive (tax rate not proportionate to tax based income)

Situs of Taxation means “place of taxation” which depends on

(a) nature of the tax and subject matter, (b) possible protection and benefit

(c ) domicile or residence of taxpayer (d) citizenship (e) source of income.