Page 30 - 2024 Employee Benefits Guide

P. 30

5. A determination by the Social Security Administration that a qualified

beneficiary is no longer disabled; beneficiary must notify us within

30 days after the later of 1) the date of final determination by the Social

Security Administration that the beneficiary is no longer disabled,

or 2) the date provided in the SPD or initial COBRA notice.

The above notices may be provided by the covered employee, a qualified

beneficiary with respect to the qualifying event, or a representative of

the employee or beneficiary. Notice by one individual will satisfy the

notice responsibility of all related qualifying beneficiaries with respect to

the qualifying event.

If the employee or qualified beneficiary does not provide notice of the

events within the time limit provided above (with respect to each event),

Texas Mutual Insurance Company is not required to make COBRA

coverage available.

Proper notification by a current employee would be the employee

completing a benefit change in Workday, or via a written notice. Proper

notification by a qualified beneficiary would be by written notice. The

written notice must include the name of the employee and qualifying

beneficiaries, the applicable qualifying event from the above-described

list, the date the qualifying event occurred, and the employee’s or

qualifying beneficiaries’ contact information. If notice is made in writing,

it must be either hand-delivered or mailed by United States mail, postage

pre-paid, and addressed to:

Attn: Human Resources—Employee Benefits

2200 Aldrich Street

Austin, TX 78723

COBRA coverage

If you elect to continue coverage under the Consolidated Omnibus

Budget Reconciliation Act of 1985 (COBRA), you and/or your dependents

will receive the same medical and dental benefits you were entitled to as

an employee provided you pay the COBRA premium. Qualifying events

for COBRA eligibility are listed in the chart below.

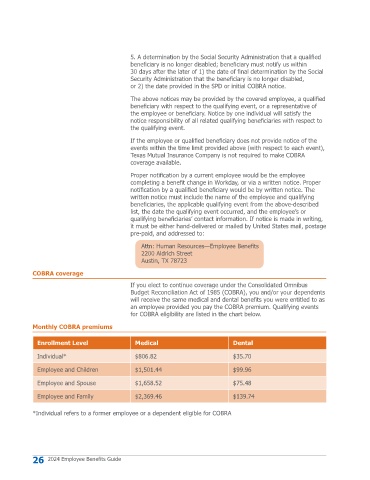

Monthly COBRA premiums

Enrollment Level Medical Dental

Individual* $806.82 $35.70

Employee and Children $1,501.44 $99.96

Employee and Spouse $1,658.52 $75.48

Employee and Family $2,369.46 $139.74

*Individual refers to a former employee or a dependent eligible for COBRA

26 2024 Employee Benefits Guide