Page 27 - Banking Finance May 2025

P. 27

ARTICLE

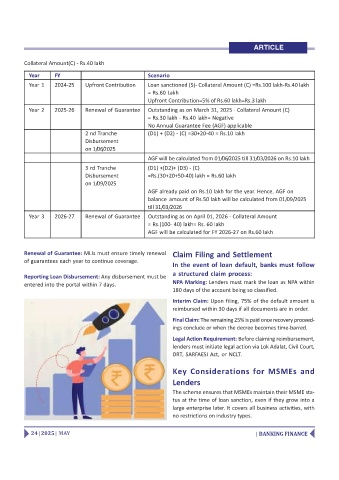

Collateral Amount(C) - Rs.40 lakh

Year FY Scenario

Year 1 2024-25 Upfront Contribution Loan sanctioned (S)- Collateral Amount (C) =Rs.100 lakh-Rs.40 lakh

= Rs.60 Lakh

Upfront Contribution=5% of Rs.60 lakh=Rs.3 lakh

Year 2 2025-26 Renewal of Guarantee Outstanding as on March 31, 2025 - Collateral Amount (C)

= Rs.30 lakh - Rs.40 lakh= Negative

No Annual Guarantee Fee (AGF) applicable

2 nd Tranche (D1) + (D2) - (C) =30+20-40 = Rs.10 lakh

Disbursement

on 1/06/2025

AGF will be calculated from 01/06/2025 till 31/03/2026 on Rs.10 lakh

3 rd Tranche (D1) +(D2)+ (D3) - (C)

Disbursement =Rs.(30+20+50-40) lakh = Rs.60 lakh

on 1/09/2025

AGF already paid on Rs.10 lakh for the year. Hence, AGF on

balance amount of Rs.50 lakh will be calculated from 01/09/2025

till 31/03/2026

Year 3 2026-27 Renewal of Guarantee Outstanding as on April 01, 2026 - Collateral Amount

= Rs.(100- 40) lakh= Rs. 60 lakh

AGF will be calculated for FY 2026-27 on Rs.60 lakh

Renewal of Guarantee: MLIs must ensure timely renewal Claim Filing and Settlement

of guarantees each year to continue coverage.

In the event of loan default, banks must follow

a structured claim process:

Reporting Loan Disbursement: Any disbursement must be

entered into the portal within 7 days. NPA Marking: Lenders must mark the loan as NPA within

180 days of the account being so classified.

Interim Claim: Upon filing, 75% of the default amount is

reimbursed within 30 days if all documents are in order.

Final Claim: The remaining 25% is paid once recovery proceed-

ings conclude or when the decree becomes time-barred.

Legal Action Requirement: Before claiming reimbursement,

lenders must initiate legal action via Lok Adalat, Civil Court,

DRT, SARFAESI Act, or NCLT.

Key Considerations for MSMEs and

Lenders

The scheme ensures that MSMEs maintain their MSME sta-

tus at the time of loan sanction, even if they grow into a

large enterprise later. It covers all business activities, with

no restrictions on industry types.

24 | 2025 | MAY | BANKING FINANCE