Page 52 - Banking Finance May 2025

P. 52

ARTICLE

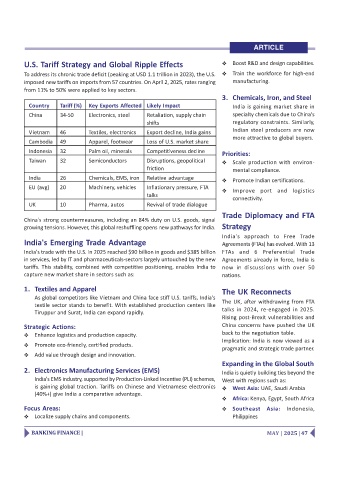

U.S. Tariff Strategy and Global Ripple Effects Boost R&D and design capabilities.

To address its chronic trade deficit (peaking at USD 1.1 trillion in 2023), the U.S. Train the workforce for high-end

imposed new tariffs on imports from 57 countries. On April 2, 2025, rates ranging manufacturing.

from 11% to 50% were applied to key sectors.

3. Chemicals, Iron, and Steel

Country Tariff (%) Key Exports Affected Likely Impact India is gaining market share in

China 34-50 Electronics, steel Retaliation, supply chain specialty chemicals due to China's

shifts regulatory constraints. Similarly,

Vietnam 46 Textiles, electronics Export decline, India gains Indian steel producers are now

more attractive to global buyers.

Cambodia 49 Apparel, footwear Loss of U.S. market share

Indonesia 32 Palm oil, minerals Competitiveness decline

Priorities:

Taiwan 32 Semiconductors Disruptions, geopolitical Scale production with environ-

friction mental compliance.

India 26 Chemicals, EMS, iron Relative advantage

Promote Indian certifications.

EU (avg) 20 Machinery, vehicles Inflationary pressure, FTA

Improve port and logistics

talks

connectivity.

UK 10 Pharma, autos Revival of trade dialogue

Trade Diplomacy and FTA

China's strong countermeasures, including an 84% duty on U.S. goods, signal

growing tensions. However, this global reshuffling opens new pathways for India. Strategy

India's approach to Free Trade

India's Emerging Trade Advantage Agreements (FTAs) has evolved. With 13

India's trade with the U.S. in 2025 reached $90 billion in goods and $385 billion FTAs and 6 Preferential Trade

in services, led by IT and pharmaceuticals-sectors largely untouched by the new Agreements already in force, India is

tariffs. This stability, combined with competitive positioning, enables India to now in discussions with over 50

capture new market share in sectors such as: nations.

1. Textiles and Apparel The UK Reconnects

As global competitors like Vietnam and China face stiff U.S. tariffs, India's

textile sector stands to benefit. With established production centers like The UK, after withdrawing from FTA

Tiruppur and Surat, India can expand rapidly. talks in 2024, re-engaged in 2025.

Rising post-Brexit vulnerabilities and

Strategic Actions: China concerns have pushed the UK

Enhance logistics and production capacity. back to the negotiation table.

Implication: India is now viewed as a

Promote eco-friendly, certified products.

pragmatic and strategic trade partner.

Add value through design and innovation.

Expanding in the Global South

2. Electronics Manufacturing Services (EMS) India is quietly building ties beyond the

India's EMS industry, supported by Production-Linked Incentive (PLI) schemes, West with regions such as:

is gaining global traction. Tariffs on Chinese and Vietnamese electronics West Asia: UAE, Saudi Arabia

(40%+) give India a comparative advantage.

Africa: Kenya, Egypt, South Africa

Focus Areas: Southeast Asia: Indonesia,

Localize supply chains and components. Philippines

BANKING FINANCE | MAY | 2025 | 47