Page 48 - Banking Finance May 2025

P. 48

ARTICLE

Inflation Protection: Annual adjustments based on 1. UPS Trust: Independent body managing the pension

Consumer Price Index fund

Risk Management Systems 2. Investment Committee: Professional experts directing

investment strategy

To maintain financial stability while providing guarantees,

the UPS includes: 3. Actuarial Board: Regular assessment of fund adequacy

Reserve Fund: A portion of contributions set aside for

4. Subscriber Council: Ensuring employee input in

market downturns

decisions

Risk Sharing: Mechanisms to distribute exceptional

5. Regulatory Oversight: Supervision by PFRDA

losses across different age groups

Contribution Rate Reviews: Periodic actuarial The system uses advanced technology including:

assessments that may adjust contribution rates A unified digital platform for all pension activities

Customized Structures: Different guarantee Secure record-keeping

frameworks for different employment categories Personalized retirement projections

Governance and Administration Mobile-accessible services

The UPS is managed through: Secure authentication for benefit payments

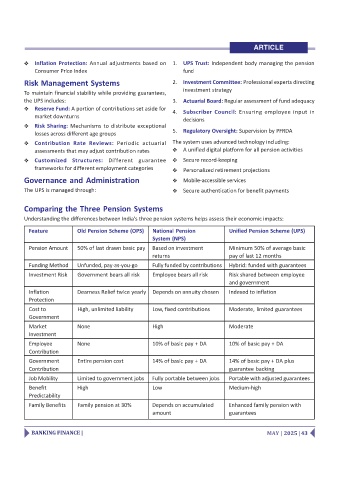

Comparing the Three Pension Systems

Understanding the differences between India's three pension systems helps assess their economic impacts:

Feature Old Pension Scheme (OPS) National Pension Unified Pension Scheme (UPS)

System (NPS)

Pension Amount 50% of last drawn basic pay Based on investment Minimum 50% of average basic

returns pay of last 12 months

Funding Method Unfunded, pay-as-you-go Fully funded by contributions Hybrid: funded with guarantees

Investment Risk Government bears all risk Employee bears all risk Risk shared between employee

and government

Inflation Dearness Relief twice yearly Depends on annuity chosen Indexed to inflation

Protection

Cost to High, unlimited liability Low, fixed contributions Moderate, limited guarantees

Government

Market None High Moderate

Investment

Employee None 10% of basic pay + DA 10% of basic pay + DA

Contribution

Government Entire pension cost 14% of basic pay + DA 14% of basic pay + DA plus

Contribution guarantee backing

Job Mobility Limited to government jobs Fully portable between jobs Portable with adjusted guarantees

Benefit High Low Medium-high

Predictability

Family Benefits Family pension at 30% Depends on accumulated Enhanced family pension with

amount guarantees

BANKING FINANCE | MAY | 2025 | 43