Page 23 - Insurance Times February 2021

P. 23

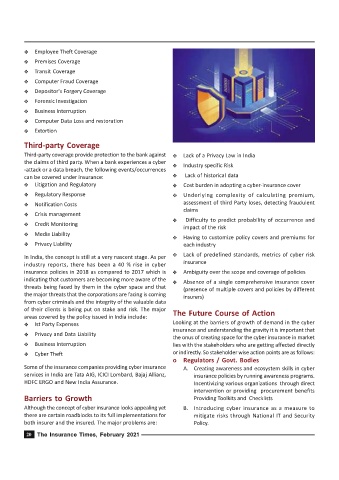

Employee Theft Coverage

Premises Coverage

Transit Coverage

Computer Fraud Coverage

Depositor's Forgery Coverage

Forensic Investigation

Business Interruption

Computer Data Loss and restoration

Extortion

Third-party Coverage

Third-party coverage provide protection to the bank against Lack of a Privacy Law in India

the claims of third party. When a bank experiences a cyber Industry specific Risk

-attack or a data breach, the following events/occurrences

can be covered under insurance: Lack of historical data

Litigation and Regulatory Cost burden in adopting a cyber-insurance cover

Regulatory Response Underlying complexity of calculating premium,

Notification Costs assessment of third Party loses, detecting fraudulent

claims

Crisis management

Difficulty to predict probability of occurrence and

Credit Monitoring

impact of the risk

Media Liability

Having to customize policy covers and premiums for

Privacy Liability each industry

In India, the concept is still at a very nascent stage. As per Lack of predefined standards, metrics of cyber risk

industry reports, there has been a 40 % rise in cyber insurance

insurance policies in 2018 as compared to 2017 which is Ambiguity over the scope and coverage of policies

indicating that customers are becoming more aware of the Absence of a single comprehensive insurance cover

threats being faced by them in the cyber space and that (presence of multiple covers and policies by different

the major threats that the corporations are facing is coming insurers)

from cyber criminals and the integrity of the valuable data

of their clients is being put on stake and risk. The major The Future Course of Action

areas covered by the policy issued in India include:

Ist Party Expenses Looking at the barriers of growth of demand in the cyber

insurance and understanding the gravity it is important that

Privacy and Data Liability

the onus of creating space for the cyber insurance in market

Business Interruption lies with the stakeholders who are getting affected directly

Cyber Theft or indirectly. So stakeholder wise action points are as follows:

o Regulators / Govt. Bodies

Some of the insurance companies providing cyber insurance A. Creating awareness and ecosystem skills in cyber

services in India are Tata AIG, ICICI Lombard, Bajaj Allianz, insurance policies by running awareness programs.

HDFC ERGO and New India Assurance. Incentivizing various organizations through direct

intervention or providing procurement benefits

Barriers to Growth Providing Toolkits and Checklists

Although the concept of cyber insurance looks appealing yet B. Introducing cyber insurance as a measure to

there are certain roadblocks to its full implementations for mitigate risks through National IT and Security

both insurer and the insured. The major problems are: Policy.

The Insurance Times, February 2021