Page 10 - Life Insurance Today April 2018

P. 10

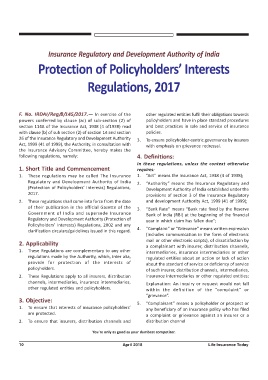

Insurance Regulatory and Development Authority of India

Protection of Policyholders’ Interests

Regulations, 2017

F. No. IRDAI/Reg/8/145/2017.— In exercise of the other regulated entities fulfil their obligations towards

powers conferred by clause (zc) of sub-section (2) of policyholders and have in place standard procedures

section 114A of the Insurance Act, 1938 (4 of1938) read and best practices in sale and service of insurance

with clause (b) of sub section (2) of section 14 and section policies.

26 of the Insurance Regulatory and Development Authority 3. To ensure policyholder-centric governance by insurers

Act, 1999 (41 of 1999), the Authority, in consultation with with emphasis on grievance redressal.

the Insurance Advisory Committee, hereby makes the

following regulations, namely: 4. Definitions:

In these regulations, unless the context otherwise

1. Short Title and Commencement requires:

1. These regulations may be called The Insurance 1. “Act” means the Insurance Act, 1938 (4 of 1938);

Regulatory and Development Authority of India 2. “Authority” means the Insurance Regulatory and

(Protection of Policyholders’ Interests) Regulations, Development Authority of India established under the

2017. provisions of section 3 of the Insurance Regulatory

2. These regulations shall come into force from the date and development Authority Act, 1999 (41 of 1999);

of their publication in the official Gazette of the 3. “Bank Rate” means “Bank rate fixed by the Reserve

Government of India and supersede Insurance Bank of India (RBI) at the beginning of the financial

Regulatory and Development Authority (Protection of year in which claim has fallen due”;

Policyholders’ Interests) Regulations, 2002 and any

clarification circulars/guidelines issued in this regard. 4. “Complaint” or “Grievance” means written expression

(includes communication in the form of electronic

mail or other electronic scripts), of dissatisfaction by

2. Applicability

a complainant with insurer, distribution channels,

1. These Regulations are complementary to any other intermediaries, insurance intermediaries or other

regulations made by the Authority, which, inter alia, regulated entities about an action or lack of action

provide for protection of the interests of about the standard of service or deficiency of service

policyholders. of such insurer, distribution channels, intermediaries,

2. These Regulations apply to all insurers, distribution insurance intermediaries or other regulated entities;

channels, intermediaries, insurance intermediaries, Explanation: An inquiry or request would not fall

other regulated entities and policyholders. within the definition of the “complaint” or

“grievance”.

3. Objective:

5. “Complainant” means a policyholder or prospect or

1. To ensure that interests of insurance policyholders’

any beneficiary of an insurance policy who has filed

are protected. a complaint or grievance against an insurer or a

2. To ensure that insurers, distribution channels and distribution channel

You're only as good as your dumbest competitor.

10 April 2018 Life Insurance Today