Page 45 - Insurance Times September 2020

P. 45

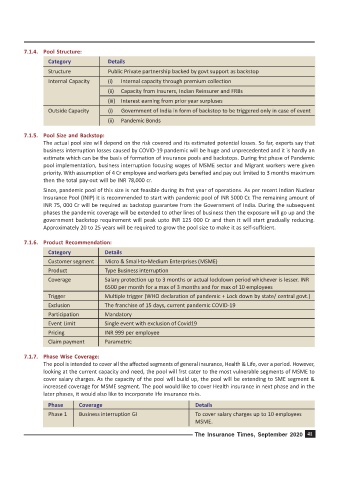

7.1.4. Pool Structure:

Category Details

Structure Public Private partnership backed by govt support as backstop

Internal Capacity (i) Internal capacity through premium collection

(ii) Capacity from Insurers, Indian Reinsurer and FRBs

(iii) Interest earning from prior year surpluses

Outside Capacity (i) Government of India in form of backstop to be triggered only in case of event

(ii) Pandemic Bonds

7.1.5. Pool Size and Backstop:

The actual pool size will depend on the risk covered and its estimated potential losses. So far, experts say that

business interruption losses caused by COVID-19 pandemic will be huge and unprecedented and it is hardly an

estimate which can be the basis of formation of insurance pools and backstops. During frst phase of Pandemic

pool implementation, business interruption focusing wages of MSME sector and Migrant workers were given

priority. With assumption of 4 Cr employee and workers gets benefted and pay out limited to 3 months maximum

then the total pay-out will be INR 78,000 cr.

Since, pandemic pool of this size is not feasible during its frst year of operations. As per recent Indian Nuclear

Insurance Pool (INIP) it is recommended to start with pandemic pool of INR 5000 Cr. The remaining amount of

INR 75, 000 Cr will be required as backstop guarantee from the Government of India. During the subsequent

phases the pandemic coverage will be extended to other lines of business then the exposure will go up and the

government backstop requirement will peak upto INR 125 000 Cr and then it will start gradually reducing.

Approximately 20 to 25 years will be required to grow the pool size to make it as self-suffcient.

7.1.6. Product Recommendation:

Category Details

Customer segment Micro & Small-to-Medium Enterprises (MSME)

Product Type Business interruption

Coverage Salary protection up to 3 months or actual lockdown period whichever is lesser. INR

6500 per month for a max of 3 months and for max of 10 employees

Trigger Multiple trigger (WHO declaration of pandemic + Lock down by state/ central govt.)

Exclusion The franchise of 15 days, current pandemic COVID-19

Participation Mandatory

Event Limit Single event with exclusion of Covid19

Pricing INR 999 per employee

Claim payment Parametric

7.1.7. Phase Wise Coverage:

The pool is intended to cover all the affected segments of general insurance, Health & Life, over a period. However,

looking at the current capacity and need, the pool will frst cater to the most vulnerable segments of MSME to

cover salary charges. As the capacity of the pool will build up, the pool will be extending to SME segment &

increased coverage for MSME segment. The pool would like to cover Health insurance in next phase and in the

later phases, it would also like to incorporate life insurance risks.

Phase Coverage Details

Phase 1 Business interruption GI To cover salary charges up to 10 employees

MSME.

The Insurance Times, September 2020 41