Page 56 - The Insurance Times January 2025

P. 56

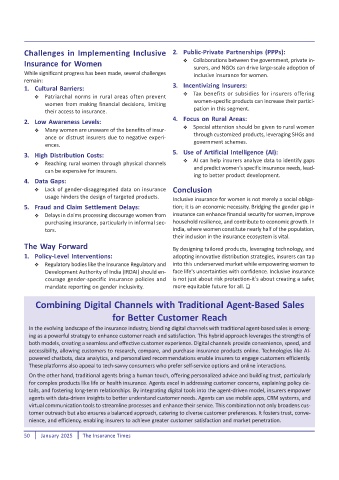

Challenges in Implementing Inclusive 2. Public-Private Partnerships (PPPs):

Insurance for Women Collaborations between the government, private in-

surers, and NGOs can drive large-scale adoption of

While significant progress has been made, several challenges inclusive insurance for women.

remain:

3. Incentivizing Insurers:

1. Cultural Barriers:

Tax benefits or subsidies for insurers offering

Patriarchal norms in rural areas often prevent

women-specific products can increase their partici-

women from making financial decisions, limiting

their access to insurance. pation in this segment.

4. Focus on Rural Areas:

2. Low Awareness Levels:

Special attention should be given to rural women

Many women are unaware of the benefits of insur-

ance or distrust insurers due to negative experi- through customized products, leveraging SHGs and

ences. government schemes.

5. Use of Artificial Intelligence (AI):

3. High Distribution Costs:

AI can help insurers analyze data to identify gaps

Reaching rural women through physical channels

can be expensive for insurers. and predict women's specific insurance needs, lead-

ing to better product development.

4. Data Gaps:

Lack of gender-disaggregated data on insurance Conclusion

usage hinders the design of targeted products.

Inclusive insurance for women is not merely a social obliga-

5. Fraud and Claim Settlement Delays: tion; it is an economic necessity. Bridging the gender gap in

Delays in claims processing discourage women from insurance can enhance financial security for women, improve

purchasing insurance, particularly in informal sec- household resilience, and contribute to economic growth. In

tors. India, where women constitute nearly half of the population,

their inclusion in the insurance ecosystem is vital.

The Way Forward By designing tailored products, leveraging technology, and

1. Policy-Level Interventions: adopting innovative distribution strategies, insurers can tap

Regulatory bodies like the Insurance Regulatory and into this underserved market while empowering women to

Development Authority of India (IRDAI) should en- face life's uncertainties with confidence. Inclusive insurance

courage gender-specific insurance policies and is not just about risk protection-it's about creating a safer,

mandate reporting on gender inclusivity. more equitable future for all.

Combining Digital Channels with Traditional Agent-Based Sales

for Better Customer Reach

In the evolving landscape of the insurance industry, blending digital channels with traditional agent-based sales is emerg-

ing as a powerful strategy to enhance customer reach and satisfaction. This hybrid approach leverages the strengths of

both models, creating a seamless and effective customer experience. Digital channels provide convenience, speed, and

accessibility, allowing customers to research, compare, and purchase insurance products online. Technologies like AI-

powered chatbots, data analytics, and personalized recommendations enable insurers to engage customers efficiently.

These platforms also appeal to tech-savvy consumers who prefer self-service options and online interactions.

On the other hand, traditional agents bring a human touch, offering personalized advice and building trust, particularly

for complex products like life or health insurance. Agents excel in addressing customer concerns, explaining policy de-

tails, and fostering long-term relationships. By integrating digital tools into the agent-driven model, insurers empower

agents with data-driven insights to better understand customer needs. Agents can use mobile apps, CRM systems, and

virtual communication tools to streamline processes and enhance their service. This combination not only broadens cus-

tomer outreach but also ensures a balanced approach, catering to diverse customer preferences. It fosters trust, conve-

nience, and efficiency, enabling insurers to achieve greater customer satisfaction and market penetration.

50 January 2025 The Insurance Times