Page 52 - The Insurance Times January 2025

P. 52

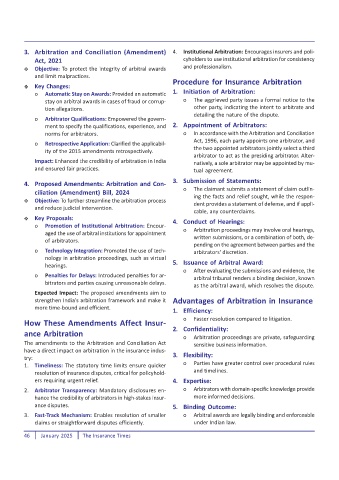

3. Arbitration and Conciliation (Amendment) 4. Institutional Arbitration: Encourages insurers and poli-

Act, 2021 cyholders to use institutional arbitration for consistency

Objective: To protect the integrity of arbitral awards and professionalism.

and limit malpractices.

Procedure for Insurance Arbitration

Key Changes:

o Automatic Stay on Awards: Provided an automatic 1. Initiation of Arbitration:

stay on arbitral awards in cases of fraud or corrup- o The aggrieved party issues a formal notice to the

tion allegations. other party, indicating the intent to arbitrate and

detailing the nature of the dispute.

o Arbitrator Qualifications: Empowered the govern-

ment to specify the qualifications, experience, and 2. Appointment of Arbitrators:

norms for arbitrators. o In accordance with the Arbitration and Conciliation

Act, 1996, each party appoints one arbitrator, and

o Retrospective Application: Clarified the applicabil-

ity of the 2015 amendments retrospectively. the two appointed arbitrators jointly select a third

arbitrator to act as the presiding arbitrator. Alter-

Impact: Enhanced the credibility of arbitration in India natively, a sole arbitrator may be appointed by mu-

and ensured fair practices. tual agreement.

3. Submission of Statements:

4. Proposed Amendments: Arbitration and Con-

o The claimant submits a statement of claim outlin-

ciliation (Amendment) Bill, 2024

ing the facts and relief sought, while the respon-

Objective: To further streamline the arbitration process dent provides a statement of defense, and if appli-

and reduce judicial intervention.

cable, any counterclaims.

Key Proposals: 4. Conduct of Hearings:

o Promotion of Institutional Arbitration: Encour-

aged the use of arbitral institutions for appointment o Arbitration proceedings may involve oral hearings,

of arbitrators. written submissions, or a combination of both, de-

pending on the agreement between parties and the

o Technology Integration: Promoted the use of tech- arbitrators' discretion.

nology in arbitration proceedings, such as virtual

hearings. 5. Issuance of Arbitral Award:

o After evaluating the submissions and evidence, the

o Penalties for Delays: Introduced penalties for ar- arbitral tribunal renders a binding decision, known

bitrators and parties causing unreasonable delays.

as the arbitral award, which resolves the dispute.

Expected Impact: The proposed amendments aim to

strengthen India's arbitration framework and make it Advantages of Arbitration in Insurance

more time-bound and efficient.

1. Efficiency:

o Faster resolution compared to litigation.

How These Amendments Affect Insur-

2. Confidentiality:

ance Arbitration

o Arbitration proceedings are private, safeguarding

The amendments to the Arbitration and Conciliation Act sensitive business information.

have a direct impact on arbitration in the insurance indus-

try: 3. Flexibility:

1. Timeliness: The statutory time limits ensure quicker o Parties have greater control over procedural rules

resolution of insurance disputes, critical for policyhold- and timelines.

ers requiring urgent relief. 4. Expertise:

2. Arbitrator Transparency: Mandatory disclosures en- o Arbitrators with domain-specific knowledge provide

hance the credibility of arbitrators in high-stakes insur- more informed decisions.

ance disputes. 5. Binding Outcome:

3. Fast-Track Mechanism: Enables resolution of smaller o Arbitral awards are legally binding and enforceable

claims or straightforward disputes efficiently. under Indian law.

46 January 2025 The Insurance Times