Page 117 - ic92 actuarial

P. 117

Foundations of Casualty Actuarial Science

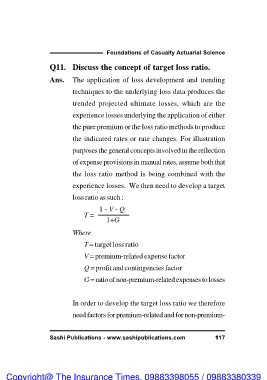

Q11. Discuss the concept of target loss ratio.

Ans. The application of loss development and trending

techniques to the underlying loss data produces the

trended projected ultimate losses, which are the

experience losses underlying the application of either

the pure premium or the loss ratio methods to produce

the indicated rates or rate changes. For illustration

purposes the general concepts involved in the reflection

of expense provisions in manual rates, assume both that

the loss ratio method is being combined with the

experience losses. We then need to develop a target

loss ratio as such :

1-V-Q

T=

1+G

Where

T = target loss ratio

V = premium-related expense factor

Q = profit and contingencies factor

G = ratio of non-premium-related expenses to losses

In order to develop the target loss ratio we therefore

need factors for premium-related and for non-premium-

Sashi Publications - www.sashipublications.com 117

Copyright@ The Insurance Times. 09883398055 / 09883380339