Page 29 - Banking Finance January 2018

P. 29

PRESS RELEASE

United Bank of India Financial Results Q2 2017-18

United Bank of India has announced its reviewed financial Business Expansion

results for the second quarter (02) of FY 2017-18 following Total Deposit increased by 7.15% from 117892 crore to

the approval of its Board of Directors on November 13, Rs.126322 crore on y-o-y basis. CASA has increased by

2017. The highlights are as follows: 16.88% on y-o-y basis with Saving Deposit increasing by

X Total Business nearing two lakh crores as on 17.98% and Current Deposit increasing by 10.72%,

September'17 increased by 4.57% over September '16. respectively on y-o-y basis. Similarly, the total business has

X Bank's total deposit increased by 7.15% on y-o-y basis increased by 4.57% on y-o-y basis.

X Strong CASA deposit growth of about 16.88% on y-o-y MSME (Priority Sector) Advance has grown by 8.50% on y-

basis helps the Bank to attain CASA share of 47.44% of o-y basis. Retail Advances has shown a growth of 10.87%

the total deposits as of 30.09.2017 as against 43.49% with Housing Loan and Car Loan increased by 21.81% and

as of 30.09.2016 29.93% respectively, on y-o-y basis. However, Total Advance

X Total advances stands at Rs.68562 crores has remained flat at Rs.68562 crore with a growth of 0.13%

X Provision coverage ratio (PCR) stands at 57.41% on Q2- on y-o-y basis.

FY 18 against 51.70% in Q2-FY 17. Bank's investments has increased from Rs.50245 crore as

X CRAR (Basel Ill) at 10.70% with Tier 1 at 7.98% as on on Q2 FY17 to Rs. 50320 crore as on Q2 FY18 showing a

30th September, 2017, against the statutory growth of 0.15% on y-o-y basis.

requirement of 10.25% and 7.00% respectively. Capital Adequacy

Under Basel III, the Bank's Capital Adequacy Ratio stood

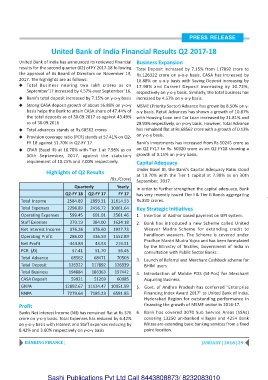

Highlights of Q2 Results

at 10.70% with the Tier 1 capital at 7.98% as on 30th

(Rs./Crore)

September, 2017.

Quarterly Yearly

In order to further strengthen the capital adequacy, Bank

Q2-FY 18 Q2-FY 17 FY 17 has very recently issued Tier I & Tier II Bonds aggregating

Total Income 2584.89 2893.31 11614.53 Rs.830 crores.

Total Expenses 2298.89 2456.72 10061.64 Key Strategic Initiatives

Operating Expenses 599.45 601.01 2561.46 1. Insertion of Aadhar based payment on UPI system.

Staff Exienses 370.19 384.00 1624.18 2. Bank has introduced a new Scheme called United

Net Interest Income 376.26 376.40 1927.73 Weaver Mudra Scheme for extending credit to

Operating Profit 286.00 436.59 1552.89 handloom weavers. The Scheme is covered under

Pradhan Mantri Mudra Yojna and has been formulated

Net Profit -344.83 43.53 219.51

by the Ministry of Textiles, Government of India in

PCR (/0) 57.41 51.70 56.45 consultation with Public Sector Banks.

Total Advance 68562 68471 70503

3. Launch of Referral and Merchant Cashback scheme for

Total Deposit 126322 117892 126939 BHIM users

Total Business 194884 186363 197442 4. Introduction of Mobile POS (M-Pos) for Merchant

CASA Deposit 59921 51269 60085 Acquiring Business

GNPA 12892.67 11134.47 10951.99 5. Govt. of Andhra Pradesh has conferred "Enterprise

NNPA 7279.64 7185.23 6591.85 Financing Index Award 2017" to United Bank of India,

Hyderabad Region for outstanding performance in

Profit financing the growth of MSME sector in 2016-17.

Banks Net Interest Income (NII) has remained flat at Rs.376 6. Bank has covered 3070 Sub Service Areas (SSAs)

crore on y-o-y basis. Total Expenses has reduced by 6.42% covering 13250 un-banked villages and 4254 Bank

on y-o-y basis with Interest and Staff expenses reducing by Mitras are extending basic banking services from a fixed

8.42% and 3.60% respectively on y-o-y basis point location.

BANKING FINANCE | JANUARY | 2018 | 29

Sashi Publications Pvt Ltd Call 8443808873/ 8232083010