Page 39 - Life Insurance underwriting Ebook IC 22

P. 39

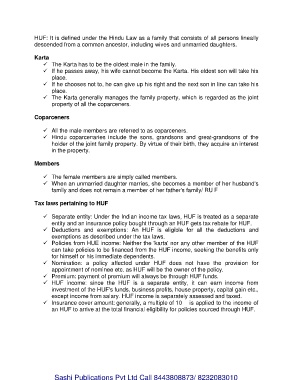

HUF: It is defined under the Hindu Law as a family that consists of all persons lineally

descended from a common ancestor, including wives and unmarried daughters.

Karta

The Karta has to be the oldest male in the family.

If he passes away, his wife cannot become the Karta. His eldest son will take his

place.

If he chooses not to, he can give up his right and the next son in line can take his

place.

The Karta generally manages the family property, which is regarded as the joint

property of all the coparceners.

Coparceners

All the male members are referred to as coparceners.

Hindu coparcenaries include the sons, grandsons and great-grandsons of the

holder of the joint family property. By virtue of their birth, they acquire an interest

in the property.

Members

The female members are simply called members.

When an unmarried daughter marries, she becomes a member of her husband's

family and does not remain a member of her father's family/ RU F

Tax laws pertaining to HUF

Separate entity: Under the Indian income tax laws, HUF is treated as a separate

entity and an insurance policy bought through an HUF gets tax rebate for HUF.

Deductions and exemptions: An HUF is eligible for all the deductions and

exemptions as described under the tax laws.

Policies from HUE income: Neither the 'karta' nor any other member of the HUF

can take policies to be financed from the HUF income, seeking the benefits only

for himself or his immediate dependents.

Nomination: a policy affected under HUF does not have the provision for

appointment of nominee etc. as HUF will be the owner of the policy.

Premium: payment of premium will always be through HUF funds.

HUF income: since the HUF is a separate entity, it can earn income from

investment of the HUF's funds, business profits, house property, capital gain etc.,

except income from salary. HUF income is separately assessed and taxed.

Insurance cover amount: generally, a multiple of 10 is applied to the income of

an HUF to arrive at the total financial eligibility for policies sourced through HUF.

Sashi Publications Pvt Ltd Call 8443808873/ 8232083010