Page 195 - IC38 GENERAL INSURANCE

P. 195

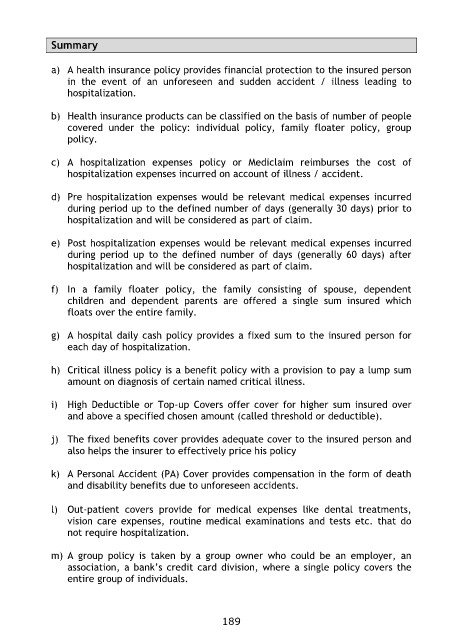

Summary

a) A health insurance policy provides financial protection to the insured person

in the event of an unforeseen and sudden accident / illness leading to

hospitalization.

b) Health insurance products can be classified on the basis of number of people

covered under the policy: individual policy, family floater policy, group

policy.

c) A hospitalization expenses policy or Mediclaim reimburses the cost of

hospitalization expenses incurred on account of illness / accident.

d) Pre hospitalization expenses would be relevant medical expenses incurred

during period up to the defined number of days (generally 30 days) prior to

hospitalization and will be considered as part of claim.

e) Post hospitalization expenses would be relevant medical expenses incurred

during period up to the defined number of days (generally 60 days) after

hospitalization and will be considered as part of claim.

f) In a family floater policy, the family consisting of spouse, dependent

children and dependent parents are offered a single sum insured which

floats over the entire family.

g) A hospital daily cash policy provides a fixed sum to the insured person for

each day of hospitalization.

h) Critical illness policy is a benefit policy with a provision to pay a lump sum

amount on diagnosis of certain named critical illness.

i) High Deductible or Top-up Covers offer cover for higher sum insured over

and above a specified chosen amount (called threshold or deductible).

j) The fixed benefits cover provides adequate cover to the insured person and

also helps the insurer to effectively price his policy

k) A Personal Accident (PA) Cover provides compensation in the form of death

and disability benefits due to unforeseen accidents.

l) Out-patient covers provide for medical expenses like dental treatments,

vision care expenses, routine medical examinations and tests etc. that do

not require hospitalization.

m) A group policy is taken by a group owner who could be an employer, an

association, a bank‟s credit card division, where a single policy covers the

entire group of individuals.

189