Page 231 - IC38 GENERAL INSURANCE

P. 231

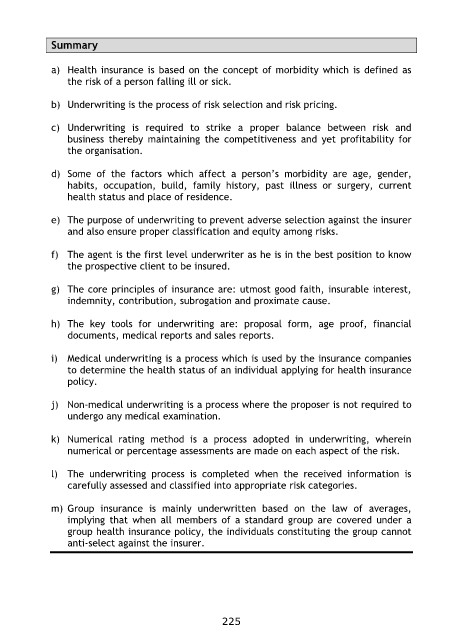

Summary

a) Health insurance is based on the concept of morbidity which is defined as

the risk of a person falling ill or sick.

b) Underwriting is the process of risk selection and risk pricing.

c) Underwriting is required to strike a proper balance between risk and

business thereby maintaining the competitiveness and yet profitability for

the organisation.

d) Some of the factors which affect a person‟s morbidity are age, gender,

habits, occupation, build, family history, past illness or surgery, current

health status and place of residence.

e) The purpose of underwriting to prevent adverse selection against the insurer

and also ensure proper classification and equity among risks.

f) The agent is the first level underwriter as he is in the best position to know

the prospective client to be insured.

g) The core principles of insurance are: utmost good faith, insurable interest,

indemnity, contribution, subrogation and proximate cause.

h) The key tools for underwriting are: proposal form, age proof, financial

documents, medical reports and sales reports.

i) Medical underwriting is a process which is used by the insurance companies

to determine the health status of an individual applying for health insurance

policy.

j) Non-medical underwriting is a process where the proposer is not required to

undergo any medical examination.

k) Numerical rating method is a process adopted in underwriting, wherein

numerical or percentage assessments are made on each aspect of the risk.

l) The underwriting process is completed when the received information is

carefully assessed and classified into appropriate risk categories.

m) Group insurance is mainly underwritten based on the law of averages,

implying that when all members of a standard group are covered under a

group health insurance policy, the individuals constituting the group cannot

anti-select against the insurer.

225