Page 253 - IC38 GENERAL INSURANCE

P. 253

iv. Outpatient treatment converted to in-patient / hospitalization to

cover cost of diagnosis, which could be high in some conditions.

With newer methods of frauds emerging on a daily basis, the insurers and

TPAs have to continuously monitor the situation on the ground and come up

with measures to find and control such frauds.

Claims are chosen for investigation based on two methods:

Routine claims and

Triggered claims

A TPA or an insurer may set an internal standard that a specific percentage

of the claims be physically verified; this percentage could be different for

cashless and reimbursement claims.

Under this method, claims are chosen using random sampling method. Some

insurers stipulate that all claims above a certain value be investigated and a

sampled set of claims which are below that limit are taken up for

verification.

In the second method, each claim goes through a set of checkpoints which if

not in line, trigger investigation such as

i. a high portion of the claim relating to medical tests or medicines

ii. customer too eager to settle

iii. bills with over-writing, etc.

If the claim is suspected to be not genuine, the claim is investigated,

however small it is.

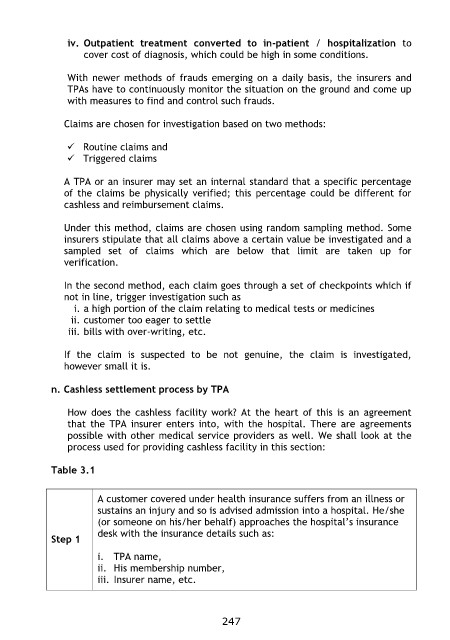

n. Cashless settlement process by TPA

How does the cashless facility work? At the heart of this is an agreement

that the TPA insurer enters into, with the hospital. There are agreements

possible with other medical service providers as well. We shall look at the

process used for providing cashless facility in this section:

Table 3.1

Step 1 A customer covered under health insurance suffers from an illness or

sustains an injury and so is advised admission into a hospital. He/she

(or someone on his/her behalf) approaches the hospital‟s insurance

desk with the insurance details such as:

i. TPA name,

ii. His membership number,

iii. Insurer name, etc.

247