Page 255 - IC38 GENERAL INSURANCE

P. 255

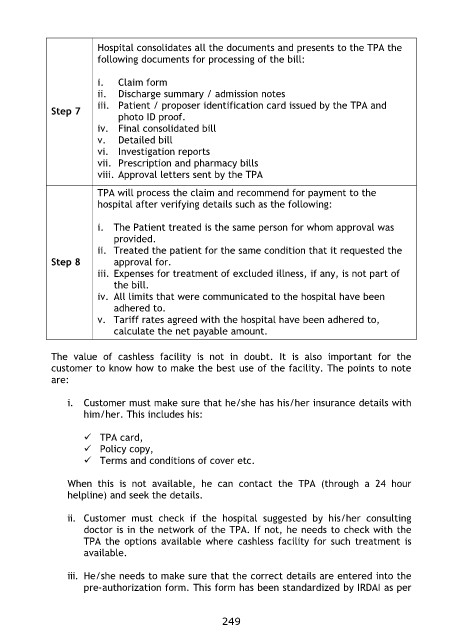

Hospital consolidates all the documents and presents to the TPA the

following documents for processing of the bill:

Step 7 i. Claim form

Step 8 ii. Discharge summary / admission notes

iii. Patient / proposer identification card issued by the TPA and

photo ID proof.

iv. Final consolidated bill

v. Detailed bill

vi. Investigation reports

vii. Prescription and pharmacy bills

viii. Approval letters sent by the TPA

TPA will process the claim and recommend for payment to the

hospital after verifying details such as the following:

i. The Patient treated is the same person for whom approval was

provided.

ii. Treated the patient for the same condition that it requested the

approval for.

iii. Expenses for treatment of excluded illness, if any, is not part of

the bill.

iv. All limits that were communicated to the hospital have been

adhered to.

v. Tariff rates agreed with the hospital have been adhered to,

calculate the net payable amount.

The value of cashless facility is not in doubt. It is also important for the

customer to know how to make the best use of the facility. The points to note

are:

i. Customer must make sure that he/she has his/her insurance details with

him/her. This includes his:

TPA card,

Policy copy,

Terms and conditions of cover etc.

When this is not available, he can contact the TPA (through a 24 hour

helpline) and seek the details.

ii. Customer must check if the hospital suggested by his/her consulting

doctor is in the network of the TPA. If not, he needs to check with the

TPA the options available where cashless facility for such treatment is

available.

iii. He/she needs to make sure that the correct details are entered into the

pre-authorization form. This form has been standardized by IRDAI as per

249