Page 300 - IC38 GENERAL INSURANCE

P. 300

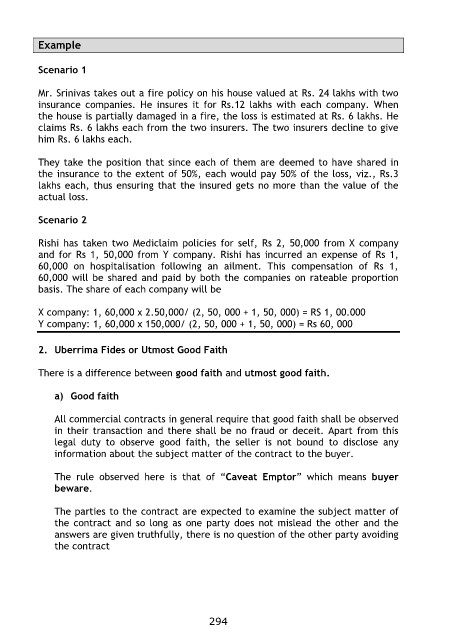

Example

Scenario 1

Mr. Srinivas takes out a fire policy on his house valued at Rs. 24 lakhs with two

insurance companies. He insures it for Rs.12 lakhs with each company. When

the house is partially damaged in a fire, the loss is estimated at Rs. 6 lakhs. He

claims Rs. 6 lakhs each from the two insurers. The two insurers decline to give

him Rs. 6 lakhs each.

They take the position that since each of them are deemed to have shared in

the insurance to the extent of 50%, each would pay 50% of the loss, viz., Rs.3

lakhs each, thus ensuring that the insured gets no more than the value of the

actual loss.

Scenario 2

Rishi has taken two Mediclaim policies for self, Rs 2, 50,000 from X company

and for Rs 1, 50,000 from Y company. Rishi has incurred an expense of Rs 1,

60,000 on hospitalisation following an ailment. This compensation of Rs 1,

60,000 will be shared and paid by both the companies on rateable proportion

basis. The share of each company will be

X company: 1, 60,000 x 2.50,000/ (2, 50, 000 + 1, 50, 000) = RS 1, 00.000

Y company: 1, 60,000 x 150,000/ (2, 50, 000 + 1, 50, 000) = Rs 60, 000

2. Uberrima Fides or Utmost Good Faith

There is a difference between good faith and utmost good faith.

a) Good faith

All commercial contracts in general require that good faith shall be observed

in their transaction and there shall be no fraud or deceit. Apart from this

legal duty to observe good faith, the seller is not bound to disclose any

information about the subject matter of the contract to the buyer.

The rule observed here is that of “Caveat Emptor” which means buyer

beware.

The parties to the contract are expected to examine the subject matter of

the contract and so long as one party does not mislead the other and the

answers are given truthfully, there is no question of the other party avoiding

the contract

294