Page 436 - IC38 GENERAL INSURANCE

P. 436

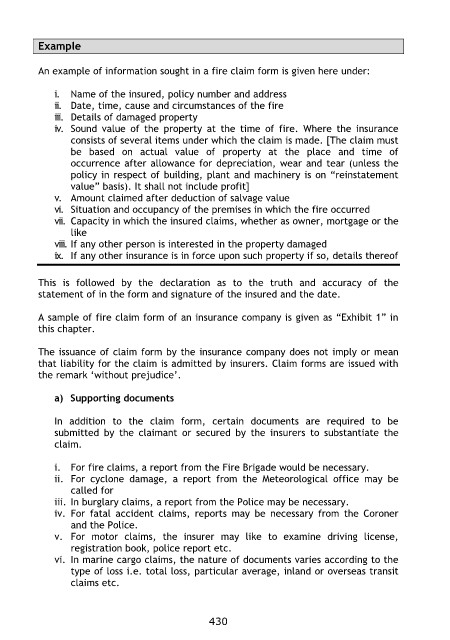

Example

An example of information sought in a fire claim form is given here under:

i. Name of the insured, policy number and address

ii. Date, time, cause and circumstances of the fire

iii. Details of damaged property

iv. Sound value of the property at the time of fire. Where the insurance

consists of several items under which the claim is made. [The claim must

be based on actual value of property at the place and time of

occurrence after allowance for depreciation, wear and tear (unless the

policy in respect of building, plant and machinery is on “reinstatement

value” basis). It shall not include profit]

v. Amount claimed after deduction of salvage value

vi. Situation and occupancy of the premises in which the fire occurred

vii. Capacity in which the insured claims, whether as owner, mortgage or the

like

viii. If any other person is interested in the property damaged

ix. If any other insurance is in force upon such property if so, details thereof

This is followed by the declaration as to the truth and accuracy of the

statement of in the form and signature of the insured and the date.

A sample of fire claim form of an insurance company is given as “Exhibit 1” in

this chapter.

The issuance of claim form by the insurance company does not imply or mean

that liability for the claim is admitted by insurers. Claim forms are issued with

the remark „without prejudice‟.

a) Supporting documents

In addition to the claim form, certain documents are required to be

submitted by the claimant or secured by the insurers to substantiate the

claim.

i. For fire claims, a report from the Fire Brigade would be necessary.

ii. For cyclone damage, a report from the Meteorological office may be

called for

iii. In burglary claims, a report from the Police may be necessary.

iv. For fatal accident claims, reports may be necessary from the Coroner

and the Police.

v. For motor claims, the insurer may like to examine driving license,

registration book, police report etc.

vi. In marine cargo claims, the nature of documents varies according to the

type of loss i.e. total loss, particular average, inland or overseas transit

claims etc.

430