Page 439 - IC38 GENERAL INSURANCE

P. 439

v. On account payment

Apart from preliminary reports, interim reports are submitted from time to

time where repairs and/or replacements are made over a long period.

Interim reports also give the insurer an idea of the development of

assessment of loss. It also helps in recommendation of "On account payment"

of the claim if desired by the insured. This usually happens if the loss is

large and the completion of assessment may take some time.

If the claim is found to be in order, payment is made to the claimant and

entries made in the company records. Appropriate recoveries are made from

the co-insurers and reinsurers, if any. In some cases, the insured may not be

the person to whom the money is to be paid.

Example

If the property insured under a fire policy is mortgaged to a bank, then

according to the “Agreed Bank Clause”, claim monies are to be paid to the

bank. Similarly claims for “Total Loss” on vehicles subject to hire purchase

agreements are paid to financiers.

Marine cargo claims are paid to the claimant who produces the marine policy

duly endorsed in his favour, at the time of the loss.

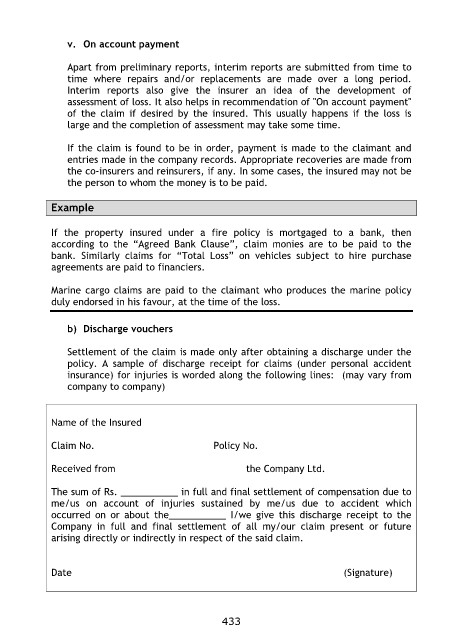

b) Discharge vouchers

Settlement of the claim is made only after obtaining a discharge under the

policy. A sample of discharge receipt for claims (under personal accident

insurance) for injuries is worded along the following lines: (may vary from

company to company)

Name of the Insured

Claim No. Policy No.

Received from the Company Ltd.

The sum of Rs. ___________ in full and final settlement of compensation due to

me/us on account of injuries sustained by me/us due to accident which

occurred on or about the___________ I/we give this discharge receipt to the

Company in full and final settlement of all my/our claim present or future

arising directly or indirectly in respect of the said claim.

Date (Signature)

433