Page 42 - Insurance Times April 2019

P. 42

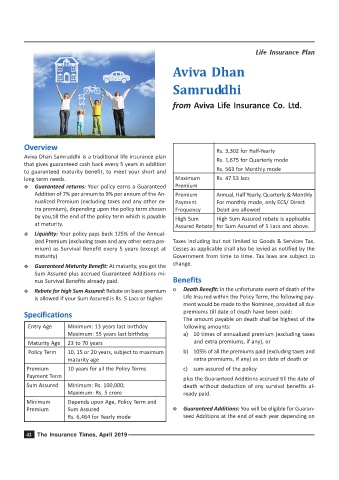

Life Insurance Plan

Aviva Dhan

Samruddhi

from Aviva Life Insurance Co. Ltd.

Overview

Rs. 3,302 for Half-Yearly

Aviva Dhan Samruddhi is a traditional life insurance plan Rs. 1,675 for Quarterly mode

that gives guaranteed cash back every 5 years in addition

to guaranteed maturity benefit, to meet your short and Rs. 563 for Monthly mode

long term needs. Maximum Rs. 47.53 lacs

Y Guaranteed returns: Your policy earns a Guaranteed Premium

Addition of 7% per annum to 9% per annum of the An- Premium Annual, Half Yearly, Quarterly & Monthly

nualized Premium (excluding taxes and any other ex- Payment For monthly mode, only ECS/ Direct

tra premium), depending upon the policy term chosen Frequency Debit are allowed

by you,till the end of the policy term which is payable High Sum High Sum Assured rebate is applicable

at maturity. Assured Rebate for Sum Assured of 5 Lacs and above.

Y Liquidity: Your policy pays back 125% of the Annual-

ized Premium (excluding taxes and any other extra pre- Taxes including but not limited to Goods & Services Tax,

mium) as Survival Benefit every 5 years (except at Cesses as applicable shall also be levied as notified by the

maturity) Government from time to time. Tax laws are subject to

change.

Y Guaranteed Maturity Benefit: At maturity, you get the

Sum Assured plus accrued Guaranteed Additions mi-

nus Survival Benefits already paid. Benefits

Y Rebate for high Sum Assured: Rebate on basic premium o Death Benefit: In the unfortunate event of death of the

is allowed if your Sum Assured is Rs. 5 Lacs or higher. Life Insured within the Policy Term, the following pay-

ment would be made to the Nominee, provided all due

Specifications premiums till date of death have been paid:

The amount payable on death shall be highest of the

Entry Age Minimum: 13 years last birthday following amounts:

Maximum: 55 years last birthday a) 10 times of annualized premium (excluding taxes

Maturity Age 23 to 70 years and extra premiums, if any), or

Policy Term 10, 15 or 20 years, subject to maximum b) 105% of all the premiums paid (excluding taxes and

maturity age extra premiums, if any) as on date of death or

Premium 10 years for all the Policy Terms c) sum assured of the policy

Payment Term plus the Guaranteed Additions accrued till the date of

Sum Assured Minimum: Rs. 100,000; death without deduction of any survival benefits al-

Maximum: Rs. 5 crore ready paid.

Minimum Depends upon Age, Policy Term and

Premium Sum Assured Y Guaranteed Additions: You will be eligible for Guaran-

Rs. 6,464 for Yearly mode teed Additions at the end of each year depending on

42 The Insurance Times, April 2019