Page 37 - Insurance Times April 2019

P. 37

Life Insurance Industry in India

IRDAI Annual Report 2017- 2018 (Excerpts)

Premium

Unit-linked products (ULIPs) registered a growth of 22.72

Life insurance industry recorded a premium income of Rs. percent premium from Rs. 52845.26 crore in 2016-17 to Rs.

458809.44 crore during 2017-18 as against Rs. 418476.62 64850.90 crore in 2017-18. On the other hand, the growth

crore in the previous financial year, registering growth of in premium from traditional products was at 7.75 percent,

9.64 percent (14.04 percent growth in previous year). While with premium Rs. 393958.54 crore as against Rs. 365631.36

private sector insurers posted 19.15 percent growth (17.40 crore in 2016-17. Accordingly, the share of unit-linked

percent growth in previous year) in their premium income, products in total premium increased to 14.13 percent in 2017-

LIC recorded 5.90 percent growth (12.78 percent growth in 18 as against 12.63 percent in 2016-17 (Statement No. 5).

previous year).

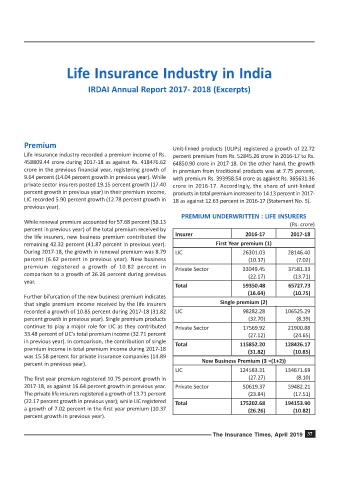

PREMIUM UNDERWRITTEN : LIFE INSURERS

While renewal premium accounted for 57.68 percent (58.13

(Rs. crore)

percent in previous year) of the total premium received by

Insurer 2016-17 2017-18

the life insurers, new business premium contributed the

remaining 42.32 percent (41.87 percent in previous year). First Year premium (1)

During 2017-18, the growth in renewal premium was 8.79 LIC 26301.03 28146.40

percent (6.62 percent in previous year). New business (10.37) (7.02)

premium registered a growth of 10.82 percent in Private Sector 33049.45 37581.33

comparison to a growth of 26.26 percent during previous (22.17) (13.71)

year.

Total 59350.48 65727.73

(16.64) (10.75)

Further bifurcation of the new business premium indicates

that single premium income received by the life insurers Single premium (2)

recorded a growth of 10.85 percent during 2017-18 (31.82 LIC 98282.28 106525.29

percent growth in previous year). Single premium products (32.70) (8.39)

continue to play a major role for LIC as they contributed Private Sector 17569.92 21900.88

33.48 percent of LIC’s total premium income (32.71 percent (27.12) (24.65)

in previous year). In comparison, the contribution of single Total 115852.20 128426.17

premium income in total premium income during 2017-18 (31.82) (10.85)

was 15.58 percent for private insurance companies (14.89

percent in previous year). New Business Premium (3 =(1+2))

LIC 124583.31 134671.69

The first year premium registered 10.75 percent growth in (27.27) (8.10)

2017-18, as against 16.64 percent growth in previous year. Private Sector 50619.37 59482.21

The private life insurers registered a growth of 13.71 percent (23.84) (17.51)

(22.17 percent growth in previous year); while LIC registered Total 175202.68 194153.90

a growth of 7.02 percent in the first year premium (10.37 (26.26) (10.82)

percent growth in previous year).

The Insurance Times, April 2019 37