Page 42 - The Insurance Times June 2020

P. 42

If Insured person is not satisfied with the redressalof norms on designing of health insurance products.

grievance through one of the above methods, insured

2. In addition to the norms specified in clause (4) of Chapter

person may contact the grievance officerat ………….

II of the guidelines, the following additional norms are

For updated details of grievance officer, kindly refer the specified.

link……….

3. Where as part of product design insurers propose

(Note to insurers: Address of the Grievance Officer proportionate deduction of the ‘associated medical

and link having updated details of grievance officer expenses’ when a policyholder chooses a higher room

on website to be specified by the insurer. Insurer to category than the category that is eligible as per terms

also specify separate contact details for senior and conditions of the policy, insurers shall define

citizens) ‘associate medical expenses’ in the terms and conditions

If Insured person is not satisfied with the redressalof of policy contract.

grievance through above methods, theinsured person 4. The following expenses are not allowed to be part of

may also approach the office of Insurance Ombudsman the definition of ‘associate medical expenses’.

of the respective area/region for redressal of a. Cost of pharmacy and consumables;

grievanceas per Insurance Ombudsman Rules 2017.

b. Cost of implants and medical devices

(Note to insurers: Insurer to specify the latest contact

details of offices of Insurance Ombudsman) c. Cost of diagnostics

Grievance may also be lodged at IRDAI Integrated 5. Insurers shall not recover any expenses towards

Grievance Management System - https:// proportionate deductions other than the defined

‘associate medical expenses’ while processing claims.

igms.irda.gov.in/

6. Insurers shall ensure that proportionate deductions are

17 Nomination: not applied in respect of the hospitals which do not

The policyholder is required at the inception of the follow differential billing or for those expenses in respect

policy to make a nomination for the purpose of of which differential billing is not adopted based on the

payment of claims under the policy in the event of death room category. This shall be clearly specified in the

of the policyholder. Any change of nomination shall be policy terms and conditions.

communicated to the company in writing and such 7. Insurers are not permitted to apply proportionate

change shall be effective only when an endorsement on deduction for ‘ICU charges’ as different categories of

the policy is made. In the event of death of the ICU are not there.

policyholder, the Company will pay the nominee {as

8. The provisions of these guidelines shall be applicable to

named in the Policy Schedule/Policy Certificate/

the Health Insurance products filed as per Guidelines

Endorsement (if any)} and in case there is no subsisting

on Product Filing in Health Insurance Business on or

nominee, to the legal heirs or legal representatives of

after 01st October, 2020. All policy contracts of the

the policyholder whose discharge shall be treated as full

existing health insurance products that are not in

and final discharge of its liability under the policy.

compliance with these guidelines shall be modified as

and when they are due for renewal from 01st April,

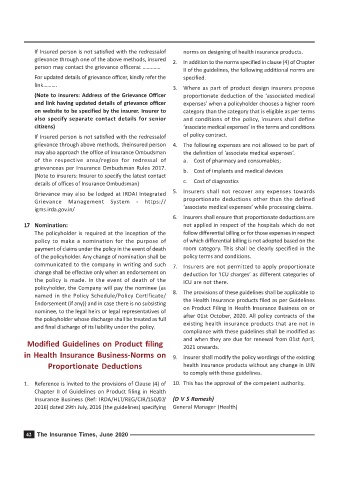

Modified Guidelines on Product filing 2021 onwards.

in Health Insurance Business-Norms on 9. Insurer shall modify the policy wordings of the existing

Proportionate Deductions health insurance products without any change in UIN

to comply with these guidelines.

1. Reference is invited to the provisions of Clause (4) of 10. This has the approval of the competent authority.

Chapter II of Guidelines on Product filing in Health

Insurance Business (Ref: IRDA/HLT/REG/CIR/150/07/ (D V S Ramesh)

2016) dated 29th July, 2016 (the guidelines) specifying General Manager (Health)

42 The Insurance Times, June 2020