Page 47 - Banking Finance August 2024

P. 47

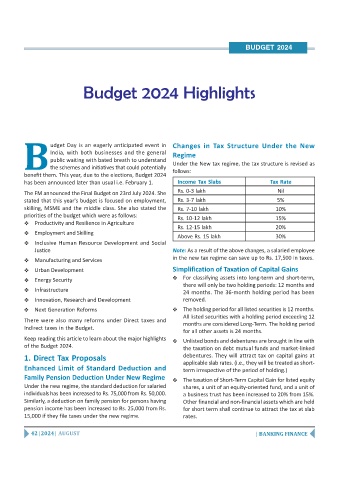

BUDGET 2024

Budget 2024 Highlights

B udget Day is an eagerly anticipated event in Changes in Tax Structure Under the New

India, with both businesses and the general

Regime

public waiting with bated breath to understand

Under the New tax regime, the tax structure is revised as

the schemes and initiatives that could potentially

benefit them. This year, due to the elections, Budget 2024 follows:

has been announced later than usual i.e. February 1. Income Tax Slabs Tax Rate

The FM announced the Final Budget on 23rd July 2024. She Rs. 0-3 lakh Nil

stated that this year's budget is focused on employment, Rs. 3-7 lakh 5%

skilling, MSME and the middle class. She also stated the Rs. 7-10 lakh 10%

priorities of the budget which were as follows: Rs. 10-12 lakh 15%

Productivity and Resilience in Agriculture

Rs. 12-15 lakh 20%

Employment and Skilling

Above Rs. 15 lakh 30%

Inclusive Human Resource Development and Social

Justice Note: As a result of the above changes, a salaried employee

Manufacturing and Services in the new tax regime can save up to Rs. 17,500 in taxes.

Urban Development Simplification of Taxation of Capital Gains

Energy Security For classifying assets into long-term and short-term,

there will only be two holding periods: 12 months and

Infrastructure

24 months. The 36-month holding period has been

Innovation, Research and Development removed.

Next Generation Reforms The holding period for all listed securities is 12 months.

All listed securities with a holding period exceeding 12

There were also many reforms under Direct taxes and months are considered Long-Term. The holding period

Indirect taxes in the Budget.

for all other assets is 24 months.

Keep reading this article to learn about the major highlights Unlisted bonds and debentures are brought in line with

of the Budget 2024. the taxation on debt mutual funds and market-linked

1. Direct Tax Proposals debentures. They will attract tax on capital gains at

applicable slab rates. (i.e., they will be treated as short-

Enhanced Limit of Standard Deduction and term irrespective of the period of holding.)

Family Pension Deduction Under New Regime The taxation of Short-Term Capital Gain for listed equity

Under the new regime, the standard deduction for salaried shares, a unit of an equity-oriented fund, and a unit of

individuals has been increased to Rs. 75,000 from Rs. 50,000. a business trust has been increased to 20% from 15%.

Similarly, a deduction on family pension for persons having Other financial and non-financial assets which are held

pension income has been increased to Rs. 25,000 from Rs. for short term shall continue to attract the tax at slab

15,000 if they file taxes under the new regime. rates.

42 | 2024 | AUGUST | BANKING FINANCE