Page 56 - Insurance Times April 2017 Special Issue on Newindia

P. 56

Glossary

Poll Will the rise in Third-party Motor Premium

benefit the commoners?

Yes Results of Poll in our March 2017 Issue

No Do you think hike in LIC agents' gratuity will

encourage them to do more business?

Can’t say

Asset You may send your views to :

Probable future economic benefits ob- Poll Contest, The Insurance Times Yes 80

tained or controlled by a particular 25/1, Baranashi Ghosh Street, Kolkata - 700 007 No 10

entity as a result of past transactions Phone : 2269 6035, 2218 4184, 4007 8428 Can’t say 10

Email: insurance.kolkata@gmail.com

or events. An asset has three essential

characteristics: It embodies a probable Norms eased by IRDAI for recruiting PoS

future benefit that involves a capacity,

singly or in combination with other as- persons

sets, to contribute directly or indirectly

to future net cash inflows; A particular With effect from 1st April 2017, IRDAI has relaxed norms for recruitment

entity can obtain the benefit and con- of Point-of-Sales (PoS) persons by general and health insurers.

trol others' access to it; and The trans- Henceforth, insurers can appoint PoS persons with the mandatory

action or other event-giving rise to the training and passing of NIELIT examination, which is already being

entity's right to or control of the ben- allowed in the case of life insurance. The insurers, however, should

efit has already occurred. ensure that the applicant for PoS position is not engaged with any other

insurer or insurance intermediary by crosschecking with the database

Asset Risk

of the Insurance Information Bureau.

In the risk-based capital formula, risk

assigned to the company's assets. They should also conduct an in-house training of 15 hours for the

candidate which would be followed by an exam.Successful candidates

Assigned Risk should be engaged as PoS persons by entering into a written

A governmental pool established to agreement, which would specify the terms and conditions, the circular

write business declined by carriers in

added.

the standard insurance market.

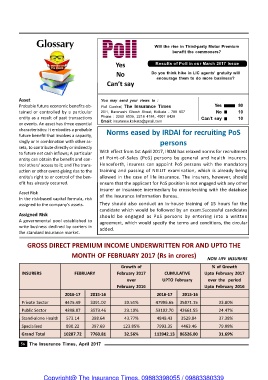

GROSS DIRECT PREMIUM INCOME UNDERWRITTEN FOR AND UPTO THE

MONTH OF FEBRUARY 2017 (Rs in crores)

NON LIFE INSURERS

Growth of % of Growth

INSURERS FEBRUARY February 2017 CUMULATIVE Upto February 2017

over UPTO February over the period

February 2016 Upto February 2016

2016-17 2015-16 2016-17 2015-16

Private Sector 4425.49 3391.02 30.51% 47996.65 35871.15 33.80%

Public Sector 4398.87 3573.46 23.10% 53102.70 42661.55 24.47%

Stand-alone Health 573.14 398.64 43.77% 4849.43 3529.84 37.38%

Specialised 890.22 397.69 123.85% 7993.35 4463.46 79.08%

Grand Total 10287.72 7760.81 32.56% 113942.13 86526.00 31.69%

56 The Insurance Times, April 2017

Copyright@ The Insurance Times. 09883398055 / 09883380339