Page 128 - IC26 LIFE INSURANCE FINANCE

P. 128

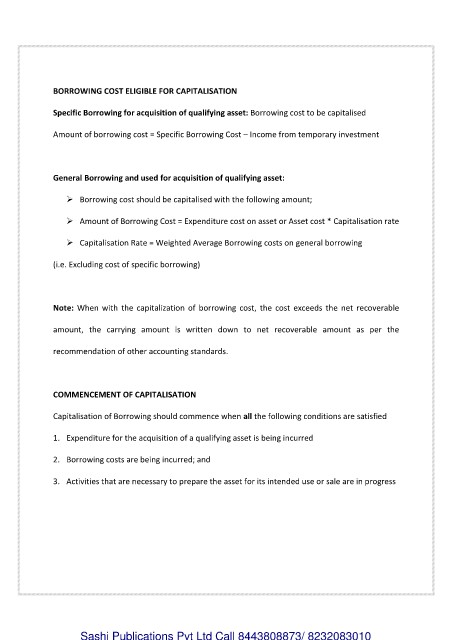

BORROWING COST ELIGIBLE FOR CAPITALISATION

Specific Borrowing for acquisition of qualifying asset: Borrowing cost to be capitalised

Amount of borrowing cost = Specific Borrowing Cost – Income from temporary investment

General Borrowing and used for acquisition of qualifying asset:

Borrowing cost should be capitalised with the following amount;

Amount of Borrowing Cost = Expenditure cost on asset or Asset cost * Capitalisation rate

Capitalisation Rate = Weighted Average Borrowing costs on general borrowing

(i.e. Excluding cost of specific borrowing)

Note: When with the capitalization of borrowing cost, the cost exceeds the net recoverable

amount, the carrying amount is written down to net recoverable amount as per the

recommendation of other accounting standards.

COMMENCEMENT OF CAPITALISATION

Capitalisation of Borrowing should commence when all the following conditions are satisfied

1. Expenditure for the acquisition of a qualifying asset is being incurred

2. Borrowing costs are being incurred; and

3. Activities that are necessary to prepare the asset for its intended use or sale are in progress

Sashi Publications Pvt Ltd Call 8443808873/ 8232083010