Page 124 - IC26 LIFE INSURANCE FINANCE

P. 124

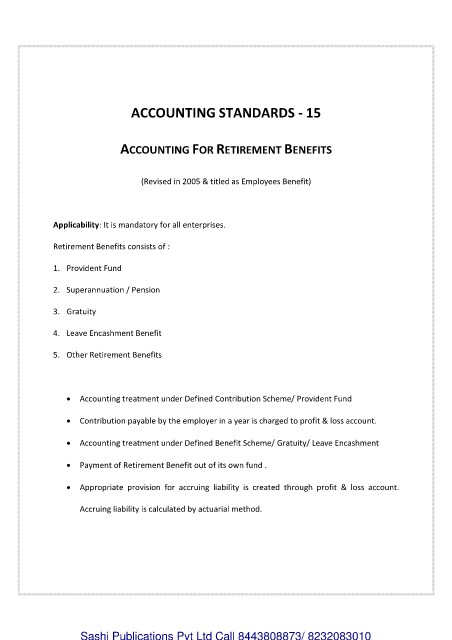

ACCOUNTING STANDARDS - 15

ACCOUNTING FOR RETIREMENT BENEFITS

(Revised in 2005 & titled as Employees Benefit)

Applicability: It is mandatory for all enterprises.

Retirement Benefits consists of :

1. Provident Fund

2. Superannuation / Pension

3. Gratuity

4. Leave Encashment Benefit

5. Other Retirement Benefits

Accounting treatment under Defined Contribution Scheme/ Provident Fund

Contribution payable by the employer in a year is charged to profit & loss account.

Accounting treatment under Defined Benefit Scheme/ Gratuity/ Leave Encashment

Payment of Retirement Benefit out of its own fund .

Appropriate provision for accruing liability is created through profit & loss account.

Accruing liability is calculated by actuarial method.

Sashi Publications Pvt Ltd Call 8443808873/ 8232083010