Page 144 - IC26 LIFE INSURANCE FINANCE

P. 144

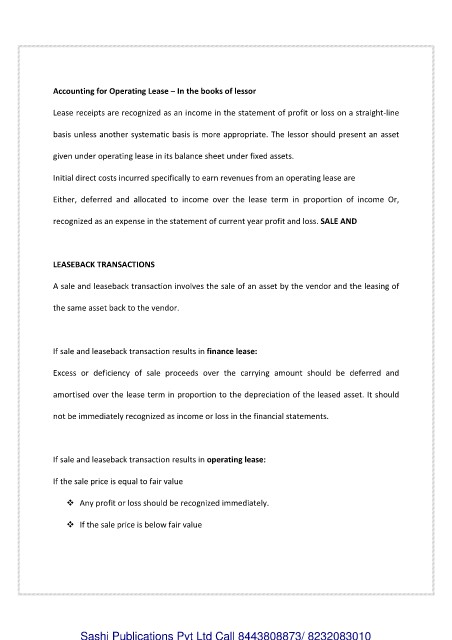

Accounting for Operating Lease – In the books of lessor

Lease receipts are recognized as an income in the statement of profit or loss on a straight-line

basis unless another systematic basis is more appropriate. The lessor should present an asset

given under operating lease in its balance sheet under fixed assets.

Initial direct costs incurred specifically to earn revenues from an operating lease are

Either, deferred and allocated to income over the lease term in proportion of income Or,

recognized as an expense in the statement of current year profit and loss. SALE AND

LEASEBACK TRANSACTIONS

A sale and leaseback transaction involves the sale of an asset by the vendor and the leasing of

the same asset back to the vendor.

If sale and leaseback transaction results in finance lease:

Excess or deficiency of sale proceeds over the carrying amount should be deferred and

amortised over the lease term in proportion to the depreciation of the leased asset. It should

not be immediately recognized as income or loss in the financial statements.

If sale and leaseback transaction results in operating lease:

If the sale price is equal to fair value

Any profit or loss should be recognized immediately.

If the sale price is below fair value

Sashi Publications Pvt Ltd Call 8443808873/ 8232083010