Page 71 - IC26 LIFE INSURANCE FINANCE

P. 71

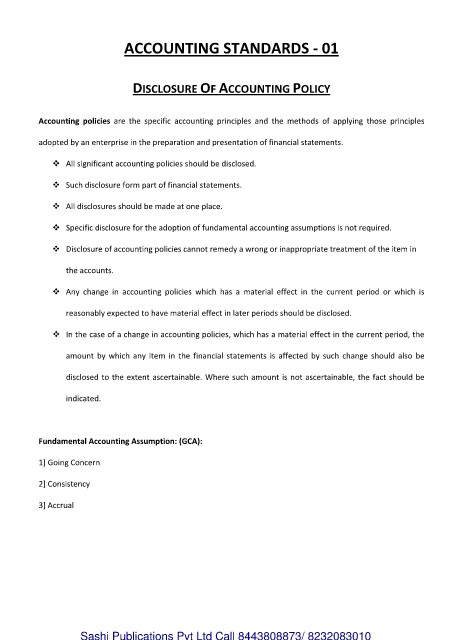

ACCOUNTING STANDARDS - 01

DISCLOSURE OF ACCOUNTING POLICY

Accounting policies are the specific accounting principles and the methods of applying those principles

adopted by an enterprise in the preparation and presentation of financial statements.

All significant accounting policies should be disclosed.

Such disclosure form part of financial statements.

All disclosures should be made at one place.

Specific disclosure for the adoption of fundamental accounting assumptions is not required.

Disclosure of accounting policies cannot remedy a wrong or inappropriate treatment of the item in

the accounts.

Any change in accounting policies which has a material effect in the current period or which is

reasonably expected to have material effect in later periods should be disclosed.

In the case of a change in accounting policies, which has a material effect in the current period, the

amount by which any item in the financial statements is affected by such change should also be

disclosed to the extent ascertainable. Where such amount is not ascertainable, the fact should be

indicated.

Fundamental Accounting Assumption: (GCA):

1] Going Concern

2] Consistency

3] Accrual

Sashi Publications Pvt Ltd Call 8443808873/ 8232083010