Page 75 - IC26 LIFE INSURANCE FINANCE

P. 75

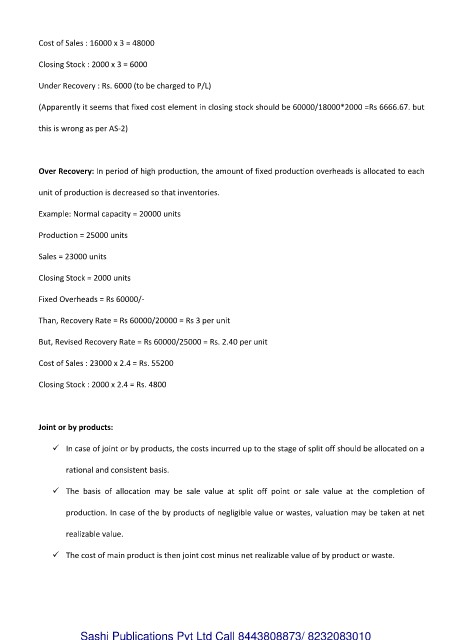

Cost of Sales : 16000 x 3 = 48000

Closing Stock : 2000 x 3 = 6000

Under Recovery : Rs. 6000 (to be charged to P/L)

(Apparently it seems that fixed cost element in closing stock should be 60000/18000*2000 =Rs 6666.67. but

this is wrong as per AS-2)

Over Recovery: In period of high production, the amount of fixed production overheads is allocated to each

unit of production is decreased so that inventories.

Example: Normal capacity = 20000 units

Production = 25000 units

Sales = 23000 units

Closing Stock = 2000 units

Fixed Overheads = Rs 60000/-

Than, Recovery Rate = Rs 60000/20000 = Rs 3 per unit

But, Revised Recovery Rate = Rs 60000/25000 = Rs. 2.40 per unit

Cost of Sales : 23000 x 2.4 = Rs. 55200

Closing Stock : 2000 x 2.4 = Rs. 4800

Joint or by products:

In case of joint or by products, the costs incurred up to the stage of split off should be allocated on a

rational and consistent basis.

The basis of allocation may be sale value at split off point or sale value at the completion of

production. In case of the by products of negligible value or wastes, valuation may be taken at net

realizable value.

The cost of main product is then joint cost minus net realizable value of by product or waste.

Sashi Publications Pvt Ltd Call 8443808873/ 8232083010