Page 83 - IC26 LIFE INSURANCE FINANCE

P. 83

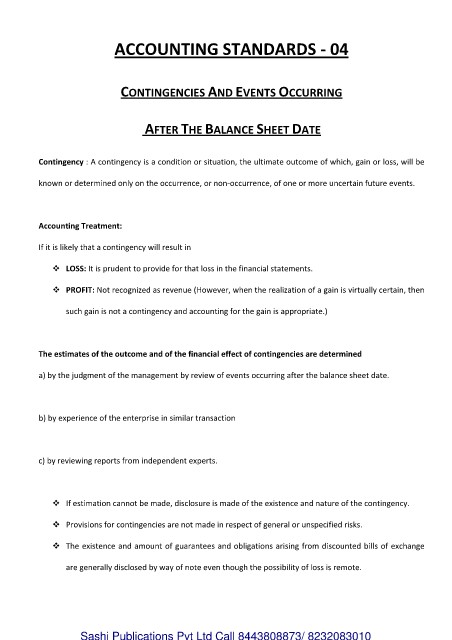

ACCOUNTING STANDARDS - 04

CONTINGENCIES AND EVENTS OCCURRING

AFTER THE BALANCE SHEET DATE

Contingency : A contingency is a condition or situation, the ultimate outcome of which, gain or loss, will be

known or determined only on the occurrence, or non-occurrence, of one or more uncertain future events.

Accounting Treatment:

If it is likely that a contingency will result in

LOSS: It is prudent to provide for that loss in the financial statements.

PROFIT: Not recognized as revenue (However, when the realization of a gain is virtually certain, then

such gain is not a contingency and accounting for the gain is appropriate.)

The estimates of the outcome and of the financial effect of contingencies are determined

a) by the judgment of the management by review of events occurring after the balance sheet date.

b) by experience of the enterprise in similar transaction

c) by reviewing reports from independent experts.

If estimation cannot be made, disclosure is made of the existence and nature of the contingency.

Provisions for contingencies are not made in respect of general or unspecified risks.

The existence and amount of guarantees and obligations arising from discounted bills of exchange

are generally disclosed by way of note even though the possibility of loss is remote.

Sashi Publications Pvt Ltd Call 8443808873/ 8232083010